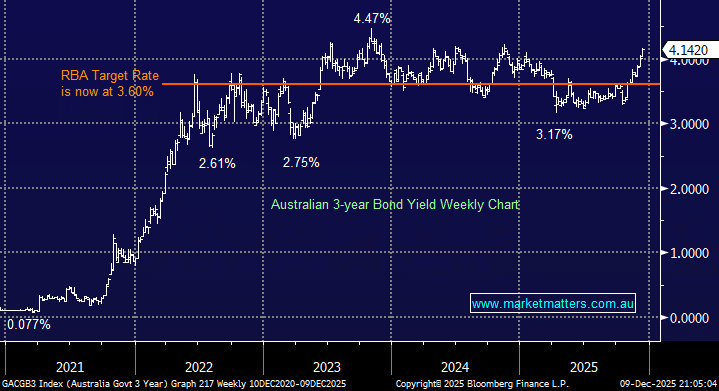

The RBA closed out 2025—a year in which it cut rates three times—with a widely expected unanimous decision to hold at 3.6%, though the pause was accompanied by unexpectedly hawkish commentary. The Australian 3-year bond yield is now more than 0.5% above the RBA Cash rate, a bit rich in our opinion, but it’s understandable after recent inflation data and the cautionary comments from Michele Bullock. In the statement and at the press conference, the RBA’s message was loud and clear, with inflation back above the board’s 2-3% target, Bullock and her board are preparing the public for potential hikes: “recent data suggest the risks to inflation have tilted to the upside.”

- We can see the 3s rotating around 4%, but short-term risks remain on the upside for yields, a headwind for stocks.