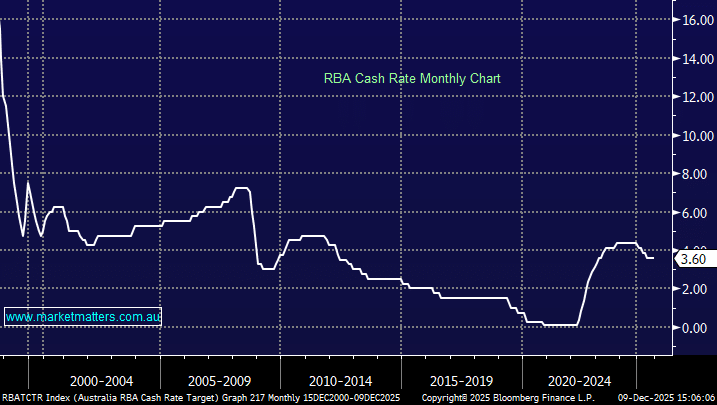

The RBA left the cash rate on hold at 3.60% today at its final meeting of the year, but the real message for markets was delivered in the nuance: inflation risks have tilted to the upside, the Board remains firmly data-dependent, and the possibility of a future hike can no longer be dismissed, even if it’s not the Bank’s central case.

Governor Michele Bullock reiterated that:

- Rate cuts are not on the horizon,

- The Board is assessing the outlook “meeting by meeting”, and

- February’s data dump – including inflation, jobs and spending — will be pivotal in determining the next move.

Inflation is clearly the driver in this conversation; however Bullock again highlighted the challenges of interpreting the new monthly CPI series, noting distortions from subsidies and one-off effects. However, Bullock made clear the Board is increasingly alert to a broader-based lift in inflation, driven by stronger private demand and lingering labour tightness.

“The balance of risks to inflation has tilted a bit to the upside.” – Bullock

Headline inflation is unlikely to fall below 3% for at least another year, and underlying measures still show persistent capacity pressures.

Employment growth has slowed modestly, but underutilisation remains low and wage growth elevated.

Bullock said the Board is watching closely:

“If there is still tightness in the labour market and inflation is not trending back down sustainably … that will be the question for the Board meeting by meeting.”

Holiday-period spending patterns are complicating the near-term read, but the RBA sees sufficient underlying momentum in private demand to justify holding the line.

All told, it looks like the RBA see one of two scenarios – an extended hold or a potential rate rise if inflation shows signs of persistence. Of course, data can change, and the move to monthly inflation figures could be having a more distorting impact on than thought, however for now, it seems no action for the foreseeable future is the most likely outcome.