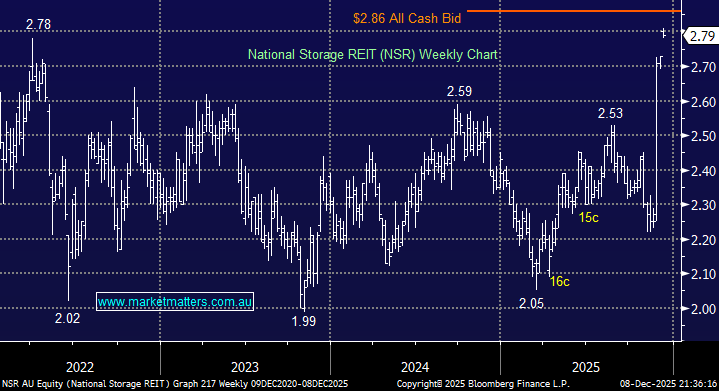

On Monday, the market received the largely expected news that Brookfield Asset Management and Singapore’s GIC had agreed on a binding deal with National Storage REIT (NSR) at $2.86, the equivalent of around $A4 billion. The NSR board unanimously recommended that shareholders vote in favour of the transaction. Following the news, NSR rose as much as 2.9% Monday morning to $2.81, trading at the highest on record and only a few cents below the bid. MM holds NSR in both its Active Growth and Active Income Portfolios. The question is, do we take profit or switch elsewhere in the property sector?

The announcement was a boost for M&A in Australia, which has witnessed a few deals falling over in recent times – EQT AB and CVC Asia Pacific. recently scrapped talks with AUB Group Ltd. about a possible takeover that had valued the Australian insurance broker at around $5.2 billion, while BHP Group walked away from a fresh offer to buy Anglo American in November.

- NSR said it expects the deal, which is subject to regulatory approvals and other conditions being met, to be completed in the second quarter of 2026 – a long time to wait for another 5c, particularly when other property stocks have fallen ~10% since the deal was announced.

Property prices have remained strong in 2025 – in Q3 they rose by +9.6% q/q, well above expectations at the time. The strength was driven by new loans for housing investors, a continuation of a multi-year theme. Overall, new lending continues to rise as home prices and housing demand have increased. Both the number and value of new investor loans notched record highs in the third quarter. Investor lending now makes up around 40% of total new housing loans each quarter. The strength in investor lending has come amid the decline in mortgage rates and near record low rental vacancy rates throughout the nation.

- Investor support for the Australian property market may fade in 2026 if interest rates do indeed rise.

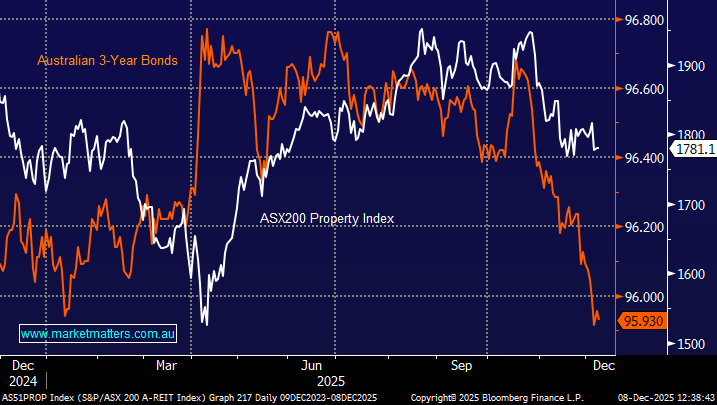

Real estate stocks have begun to struggle as local bond prices have declined and yields have risen, following a sharp reversal in market sentiment about the future path of domestic interest rates. The two are usually strongly correlated with property markets revelling in low-interest-rate environments. However, at the moment, the 3s have fallen far more aggressively than the property sector, which doesn’t bode well for the sector unless Michele Bullock surprises the market with a more dovish tone following today’s rate announcement.

This morning we’ve looked at four ASX real estate stocks as we consider whether to switch our NSR funds to another real estate name. With the sector just over 6% of the ASX200, it wouldn’t be an overly aggressive move.

- We reduced our exposure to the rate-sensitive property sector in October as yields turned higher by selling Mirvac (MGR) – Alert – at $2.30.

Today, we consider whether it’s time to fade the underperformance in property stocks in recent times, although we note it’s a tricky time with many of them reporting this month.