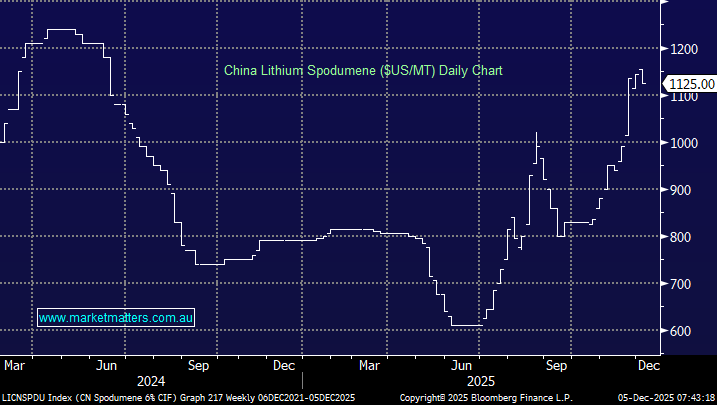

The lithium sector has pushed higher in recent weeks helped by a Morgan Stanley report citing the commodity as having reached a “turning point,” thanks to signs of improving sentiment—driven by falling inventories and softer-than-expected supply growth. The combination of the increased rate of EV purchases and increasingly bullish estimates of surging demand for battery storage due to AI have been the catalyst for the advance, and while these are very real macro drivers, there is now a lot built into the market short term, especially with plenty of supply waiting to come out of mothballs at higher prices – at the time the report helped drive lithium above $US1,000 where it’s now looking comfortable.

- We can still see lithium testing the $US1,200 over the coming months but that’s not a big call now.