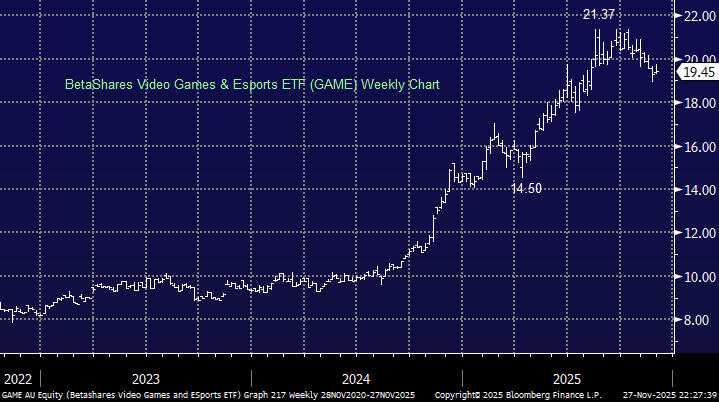

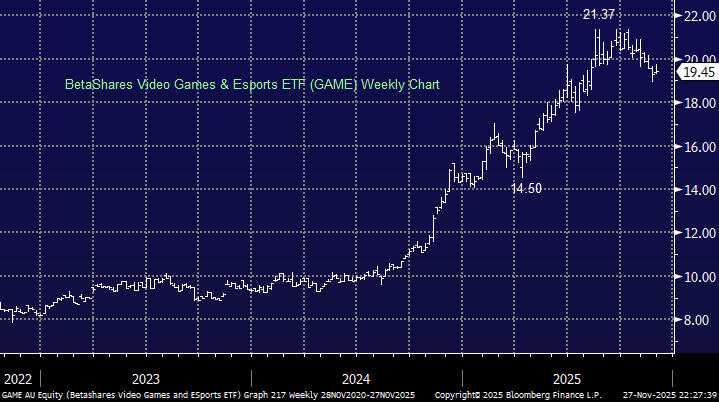

This ETF aims to track the performance of a diversified portfolio of global video-gaming and esports companies – anyone with children or grandchildren will understand how this area is booming. Gaming has become a major global entertainment and digital-culture sector, with FY25 revenue estimated to be well in excess of $250bn. Revenues are rising from game sales, in-game purchases, cloud gaming, esports and subscriptions, and the GAME ETF provide good exposure to this growth theme by bundling a broad range of gaming companies across countries and sub-segments into a single portfolio.

- The ETF holds 46 stocks, with its 5 largest positions currently Electronic Arts, NetEase, Tencent, Take-Two, and Unity Software.

- It’s relatively small with $44mn market cap, while its fees are reasonable at 0.57%.

- Note this ETF is not hedged, so local investors are carrying FX exposure: 35% Japan, 33% the US, 21% China, and 6% Korea.

This ETF gives diverse exposure to a thematic we like at MM for further growth, with the ASX offering little in the way of individual stocks in a sector dominated by large overseas players.

- We like the risk/reward towards the GAME ETF around $19 and can see new highs into 2026.