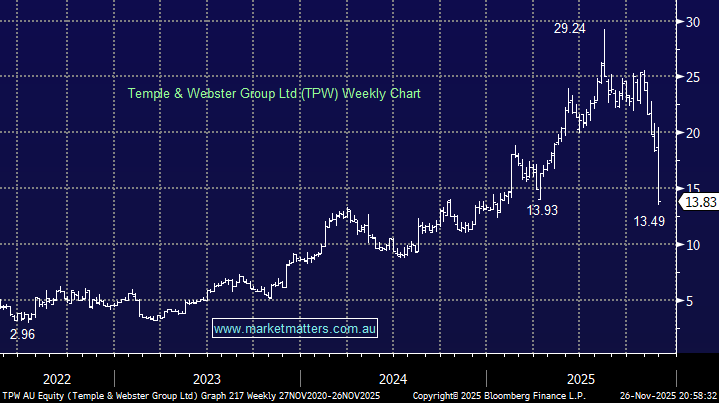

TPW tumbled more than 33% on Wednesday, its largest fall in nine years after the online furniture retailer reported a slowdown in sales growth – not ideal for a stock priced for such strong growth. It’s still on 38x earnings (EV/EBITDA), compared to JB Hi-Fi on 10.6x, Nick Scali on 11.4x, and Lovisa on 12.4x, although it is growing at a lot higher rate.

Sales from July 1 to Nov. 20 rose +18% year-on-year, compared to an increase of +28% during the July 1 to Aug. 11 period. Expectations were for growth of ~23% for the current half. The magnitude of the slowdown was especially surprising given recent updates from peers Nick Scali. and Adairs, and the stock was dealt with accordingly:

- TPW reported revenue growth of +18% YoY, below the +23% expected.

- TPW still sees EBITDA margin of 3-5%.

- TPW has a cash balance of over $150mn and is ready to deploy an on-market share Buyback.

With December typically a quieter month for TPW, there’s no hurry to 2nd guess where the market perceives value, especially as stocks have generally followed through on the downside in 2025 after delivering “misses.” Gerry Harvey made a few comments on TPW in his usual style, “Temple & Webster is overpriced to buggery”

- We think TPW still has a solid growth trajectory, however, when we see slight chinks relative to expectations in a period where peers have been solid, we become more cautious.