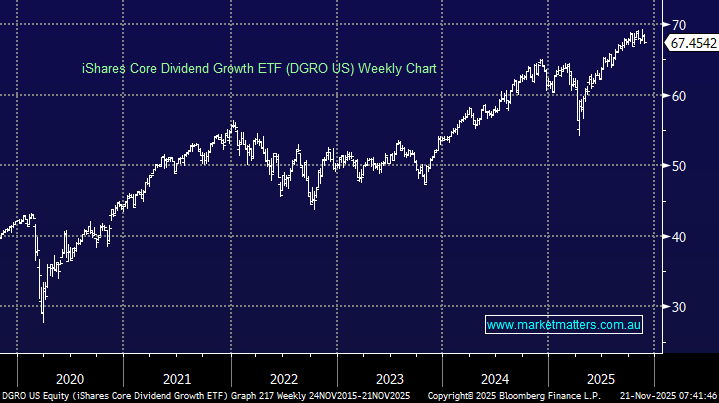

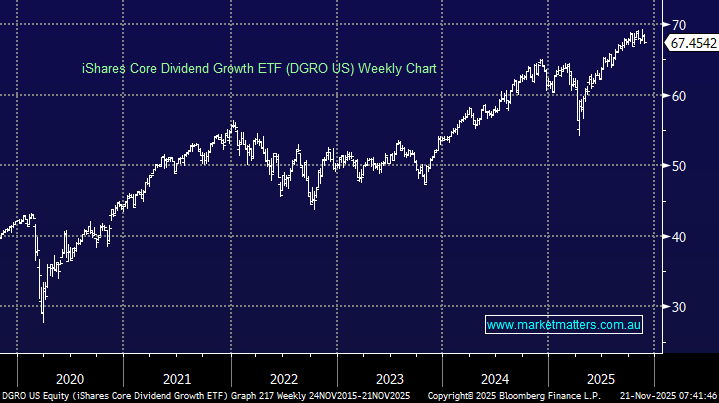

The iShares Core Dividend Growth ETF (DGRO) is one of the largest and most successful exchange-traded funds in this class. Its diverse portfolio of approximately 400 U.S. stocks is culled by screening for five years of uninterrupted dividend growth, dividend payouts not exceeding 75% of earnings – a self-imposed quality screen for investors.

- The ETF holds 403 stocks, with its 5 largest positions currently Apple, Exxon Mobil, JP Morgan, AbbVie, and Microsoft.

- It has a whopping market cap of $US34bn, while its fees are very low at 0.08%.

- Note this ETF is not hedged, so local investors are carrying $US exposure.

While this is a popular ETF in the US for yield, generally, it makes little sense for Australian investors to consider this sort of approach given we operate in a yield heavy market, with a favorable tax structure (via franking). It makes a lot more sense to MM to invest in Australia for yield, and internationally for growth.

- We have no interest investing in the US market for yield, although we do think this ETF will outperform growth focused ETS’s into Christmas.