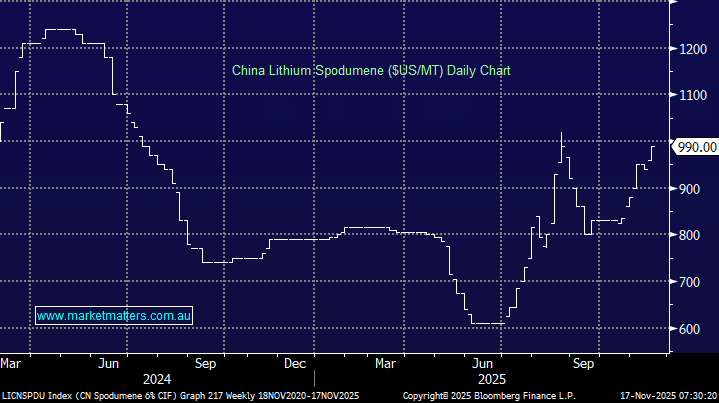

The lithium sector exploded higher last week helped by Mineral Resources (MIN) deal with Posco and a well-received report from Morgan Stanley: The banks analysts believe that the lithium market has reached a “turning point,” thanks to signs of improving sentiment—driven by falling inventories and softer-than-expected supply growth. Also, MS highlighted that demand from China’s EV and battery storage is showing strength. The lithium spodumene price is back around $US1,000 and uneconomic mines are back in sight of their profitability watermarks.

The ASX lithium names soared last week for the above reasons and substantial short position being squeezed, further upside looks/feels likely but after stocks have outperformed so dramatically they are likely to plateau at the hint of weakness in the underlying lithium price.

- We can see lithium testing the $US1,200 over the coming months.