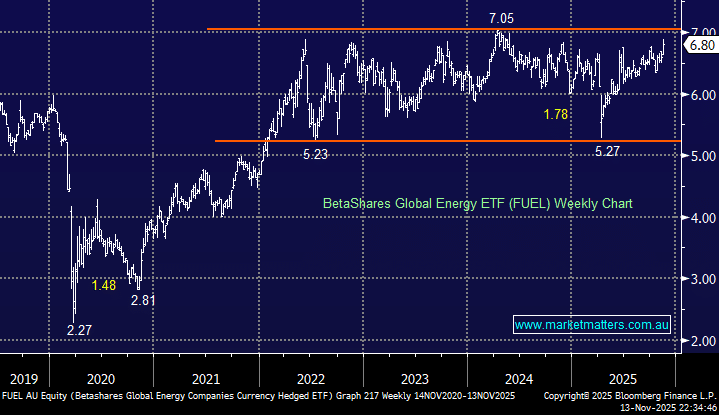

This major ASX-traded global energy ETF allows investors to gain exposure to the international energy names, currency hedged. Energy has been quiet through 2025 compared to the metals, but never say never when it comes to volatility:

- The ETF holds 46 stocks, with its 5 largest positions currently Exxon, Chevron, TotalEnergies, Enbridge, and BP.

- From a regional perspective, it has 50% exposure to the US, 18% Canada, 12% UK, 7 % France, and 4% Germany.

- It has a relatively small $128mn market cap, while its fees are a reasonable 0.57%.

However, the FUEL ETF costs money to hold and delivers an uncertain, unfranked yield. For investors who want to start positioning themselves for higher oil and gas prices, Woodside (WDS) would still get our vote. It’s highly correlated and pays an attractive fully franked yield.

- We are looking for the FUEL ETF to pop above $7 in the coming weeks/months.