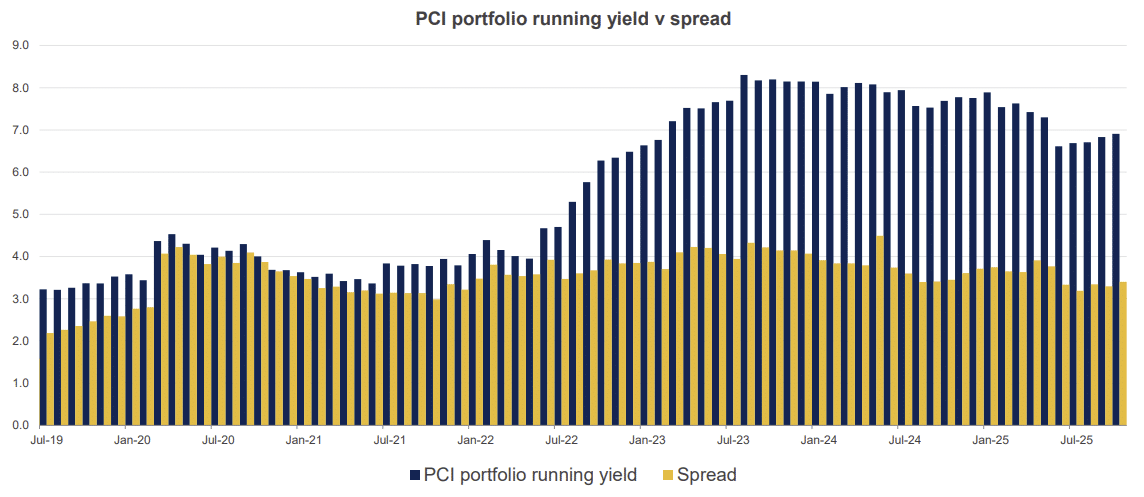

PCI is a listed investment trust (LIT) managed by Perpetual, designed to deliver monthly income by investing in a diversified portfolio of credit and fixed-income assets. We hold a position in the Income Portfolio with a 5% weighting, acquired in July 2024 at $1.11. To date, the trust has delivered to expectations, and we view this as a solid, diversified income holding, managed in a sensible way to achieve its yield objective of the RBA Cash Rate +3.25%. PCI currently has a running yield of 6.9%, having delivered a total annual return of 8.6% over the past 3-years, generated from 50-100 credit/fixed-income assets diversified by country, asset type, credit quality, issuer and maturity.

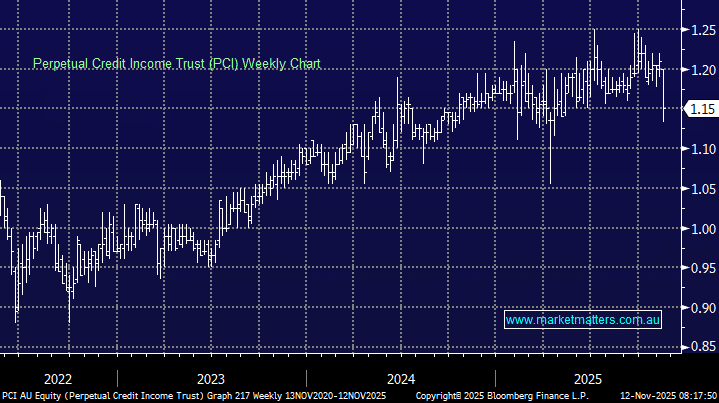

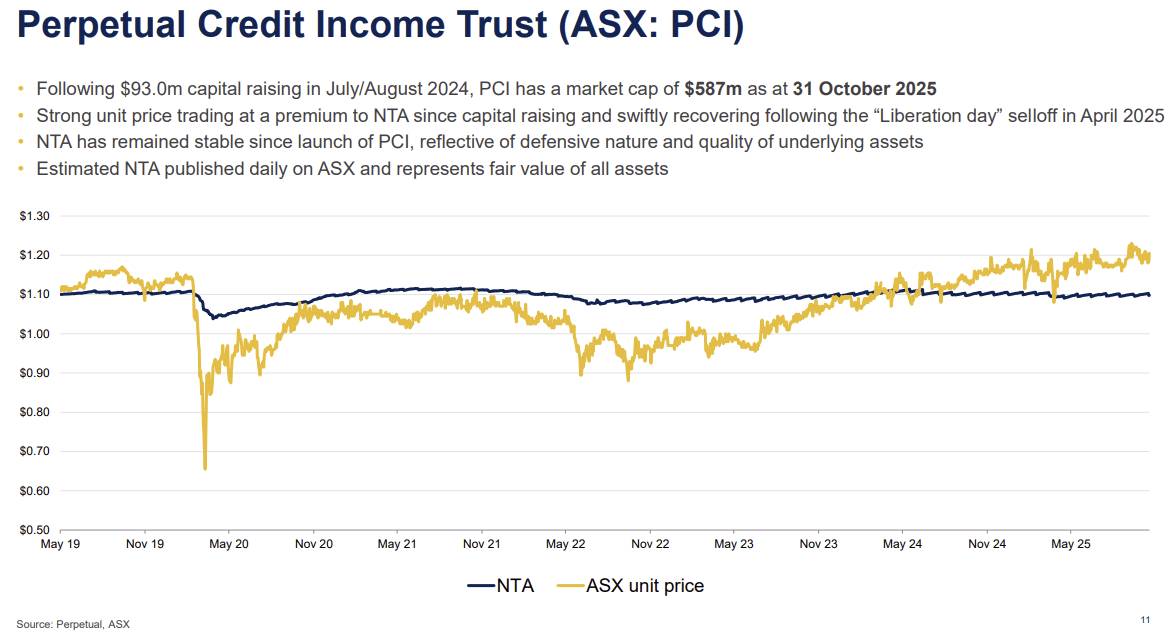

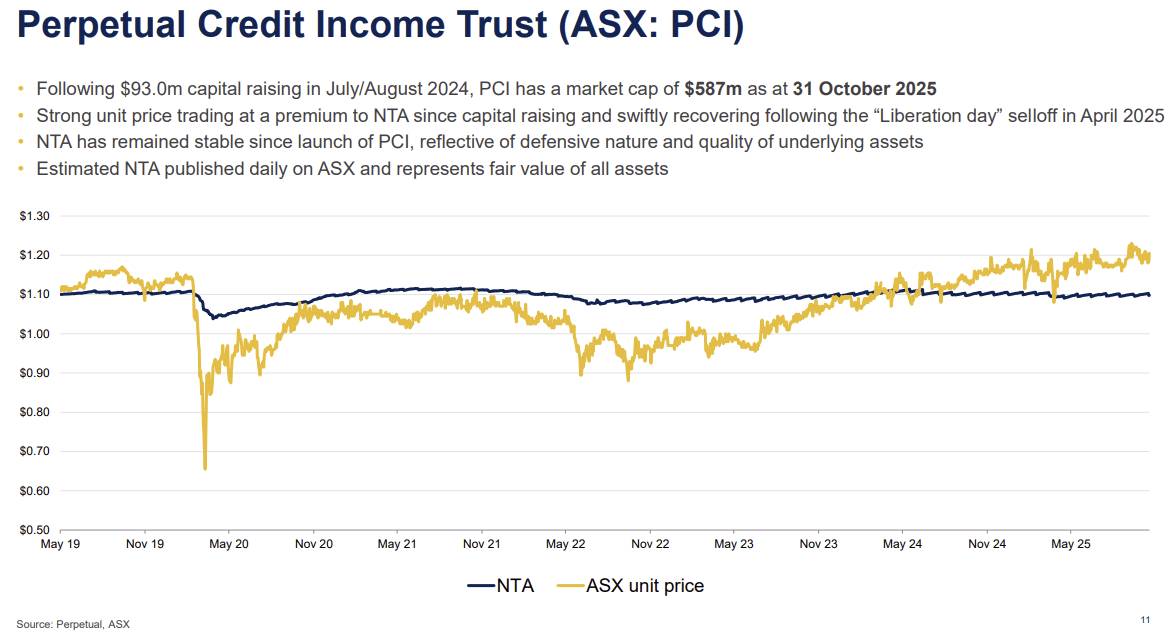

- This week, they announced a capital raise at net tangible asset (NTA) – $1.10, and given that the price was trading above NTA, the securities have fallen in value, from around $1.20. The fall is simply a result of the new issue of securities at NTA, rather than anything untoward around performance or composition of the portfolio.

We like the security for several key reasons:

- They invest primarily in high-quality corporate debt, not smaller, riskier issuers. They are not concentrated in property or development funding, as many are in the private credit space.

- They have a higher degree of transparency than others; their portfolio is transparently priced, so we know the value of what we are buying. Funds dominated by private credit securities typically hold them at par, which may not be a true reflection of their value.

- PCI use the ratings of external agencies, which provide oversight. While they also internally rate each security they hold, many others publish internal ratings to justify the quality of their book – we prefer externally rated securities.

- The maturity profile is shortish at 3.2 years, and the portfolio is a mature one, having been around a while, and the guys managing the portfolio appear conservative.

- Shares were trading above NTA; however, with the new issue being priced at NTA of $1.10, the securities have declined in price, with a management fee of 0.88% being okay.

- Importantly, PCI do not retain borrower-paid upfront fees, generally called origination fees. This is a murky area in the private credit space in particular, with many managers pocketing these upfront fees, which skews the alignment with the end investor.

- Since inception, NTA has been very stable – more so than the price of the trust on the ASX, as the below chart shows.

- We view this as a fairly conservative, diversified portfolio spanning a cross-section of fixed-income that has a greater chance of outperformance relative to an index-tracking fund in the current economic climate.

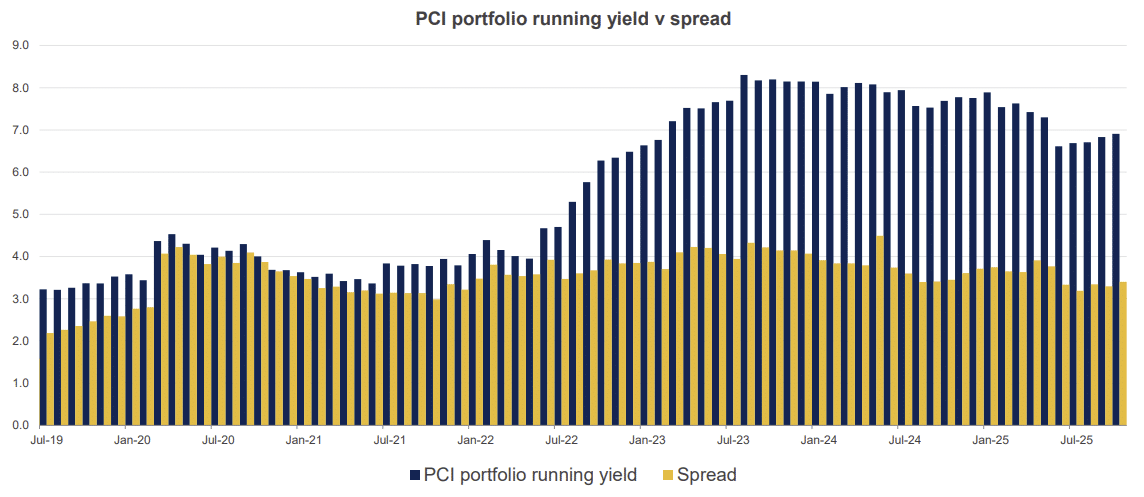

An area we have highlighted with other issuers, is the increasing risk taken to achieve the return objective. In credit markets, higher returns can come either from: Higher-risk credit exposure (e.g. lower-rated or illiquid instruments), or spread compression (capital gains as risk premia narrow). This means that PCI isn’t chasing performance via spread compression (i.e. buying lower-quality or riskier credit purely to profit from spreads tightening). Instead, most of its return is coming from the steady income stream of interest payments from its diversified pool of loans, bonds, and securitised credit.

- In other words, PCI has not materially increased risk exposure to chase performance, which is something we’ve observed in other issuers.

The new raise is structured as a pro-rata, non-renounceable entitlement offer, meaning existing holders can buy 1 new unit for every 2 held at $1.10, a discount of ~4% relative to yesterdays close, and ~9% relative to the price before the deal was announced. In the Market Matters Portfolio, given the cost of PCI and the portfolio weighting, the current cost is 0.044% per annum (multiply MER of PCI by the weighting). We are likely to take up the offer, increasing the position size to ~7.5% of the portfolio, costing the portfolio 0.066% annually in external manager fees.

We like PCI’s diversified approach, with the flexibility to move around the credit spectrum to where the best risk adjusted returns are available. Unlike a purely private credit portfolio, which must invest in that sector, even if bonds or other credit instruments are offering better risk/reward dynamics.

- Overall, this is a solid income security that we intend to hold, increasing the weighting in the income portfolio via this offer.