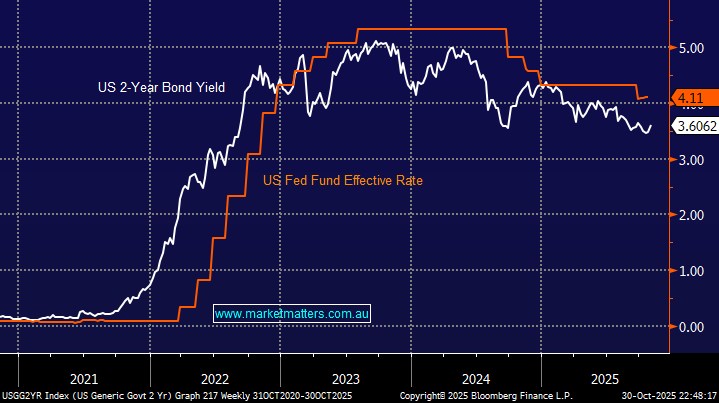

Over the past 24 hours, optimism for rate cuts before Christmas has faded on both sides of the Pacific. Markets now expect the RBA to deliver, at most, a single cut by next Christmas, while the Fed is projected to ease three times, with a possible fourth by Christmas 2026 — both outlooks notably far less dovish than just a week ago. Effectively, the goal posts have moved, which has created some sharp reversion in stocks, but today we consider what ETFs work best if interest rates are set to fall by less than expected, or simply don’t change.

- We are leaning towards no RBA cuts through 2026 following this week’s hot CPI and Michele Bullock’s ongoing conservative rhetoric towards rate cuts.

- Similarly, Jerome Powell has warned markets not to assume that another rate cut is inevitable in December following this week’s 0.25% easing.

The Australian economy continues to grapple with “sticky” inflation, which remains above the RBA’s target, alongside a weakening employment outlook. This week, we even used the term “stagflation,” and the ASX 200 has quickly slipped well below its recent high above 9100. In the U.S., inflation is moderating but remains above some central-bank targets, as markets weigh the potential impact of tariffs. The labour market is still relatively tight, but signs of it slowing suggest the Fed can still consider rate cuts, albeit cautiously.

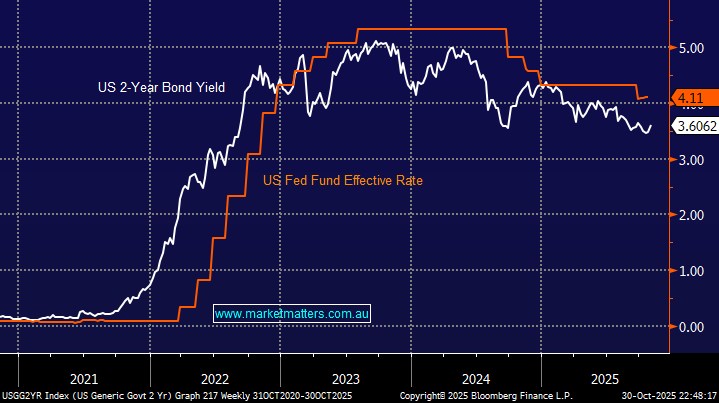

US short-dated bond yields touched their lowest level in over 3-years this month, with credit markets looking for an aggressive path of rate cuts by the Fed, but Jerome Powell has warned traders to cool their jets, a bit like Michele Bullock through much of 2025. With 3-4 rate cuts now expected by next Christmas, the US 2s trading ~0.5% below the effective cash rate feels about right with the short-term risks on the upside.

This morning we’ve looked at 3 ETFs that might outperform if inflation becomes increasingly sticky and the RBA eases less than expected. Note, we kept to the ASX this morning as we have a bearish medium-term view on the $US.