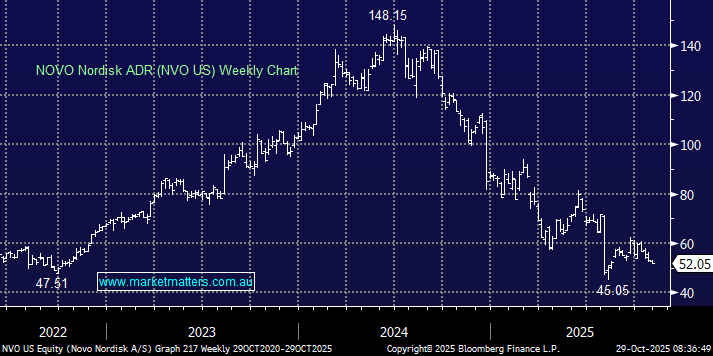

In 2022-2023, GLP-1 drugs — Ozempic / Wegovy / Mounjaro — exploded into the mainstream and obesity treatment became the hottest sector in global healthcare, if not the entire global market. Funds that normally ignored healthcare piled into Novo Nordisk (NVO US) and Eli Lilly (LLY US). Analysts began forecasting that the obesity drug market could exceed US$100–150bn a year by the early 2030s — up from basically zero as a recognised and reimbursed category. Shares in Novo, the Danish owner of Ozempic and Wegovy, traded to a peak of 40x earnings, above $US140/sh for the American Depository Receipts (ADRs) – the world was universally bullish.

Then the cracks appeared. Supply couldn’t keep up with demand, pushing patients towards compounded generics. Competition intensified, forward sales guidance was cut, and the stock lost around two-thirds of its value. Today, NVO trades on ~13.5x earnings — priced for very little growth. The sector has just endured a dramatic sentiment reset: lofty expectations eventually find gravity.

In its most recent update, Novo cut FY25 sales growth guidance to 8–14% (from 13–21%), operating profit growth to 10–16% (from 16–24%), confirmed the loss of close to 1 million U.S. patients to cheaper compounded alternatives, and announced a CEO transition — further heightening execution risk (Maziar “Mike” Doustdar took the helm on 7 August).

- These kinds of revisions damage confidence. In a growth theme like GLP-1 obesity, the market expects smooth scaling. When that stalls, the valuation premium compresses — and we’ve seen that play out.

Quarterly numbers next week (5 November), the first under the new CEO, brings uncertainty. Expectations may get reset again, though this also provides an opportunity to refocus investors on the longer-term story, which we believe remains intact.

The obesity and diabetes markets remain two of the most powerful secular growth themes globally:

- Over 1 billion people are projected to be living with obesity by 2030

- GLP-1 adoption remains in its infancy in most major economies

- Novo retains category leadership, brand strength and unmatched manufacturing scale

This isn’t a fading story, it’s simply endured a difficult 12–18 months. Scale remains the central pillar. Novo expects to invest ~US$9bn in 2025 to expand supply chain capacity (up from US$6.3bn in 2024). A key project is a US$4.1bn second fill-and-finish plant in North Carolina dedicated to GLP-1 injectables, expected to come online around 2027–29.

They have also expanded via acquisition, adding three fill-and-finish sites in Italy, Belgium and the U.S. through the Catalent transaction. These investments directly target the supply-chain bottlenecks that caused so many issues, but scale takes time and capital, and doesn’t guarantee immediate upside. It does, however, reduce one of the biggest ongoing execution risks: manufacturing capacity.

- The bigger question is timing: when does incremental capacity translate into margin and earnings growth — and how will the market reward it?

In the short term, that’s unclear, and next week’s quarterly should give better visibility.

But it’s not all doom and gloom. The last update still implied ~20% operating profit growth this year. On a PEG basis, NVO trades at just ~0.65x. Compare that with CSL who told us yesterday they expect 4–7% profit growth, trading on ~16x earnings, for a PEG of ~2.9x. (PEG = PE ÷ EPS growth).

- We’re keen to see the quarterly before making any moves, but Novo is now a high-quality global leader trading at a compelling valuation.