- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX 200 recovered stoically from early weakness to finish up +0.4% on Monday, supported by the banks and insurers, while the resources names experienced a rare day in the “naughty corner”. Commonwealth Bank (CBA) surged more than 2% to $172.70, leading the “Big Four” higher and helping the financials sector to its highest-ever close at a combined value of almost $950 billion. At the other end of the spectrum, the gold sector sold off with heavyweight Newmont (NEM) one of the worst performers, tumbling -5.7% although the stock remains up +138% year-to-date. Conversely, shares of Australian rare earths miners rose ahead of Prime Minister Anthony Albanese’s scheduled meeting with US President Donald Trump, where supply chain issues will be discussed – heavyweight Lynas (LYC) was the main board’s top performer, finishing +6.6%.

- With the futures market factoring in a 66% chance of a rate cut on Melbourne Cup Day, we can see further outperformance by the rate-sensitive banks, real estate and tech names in the coming weeks.

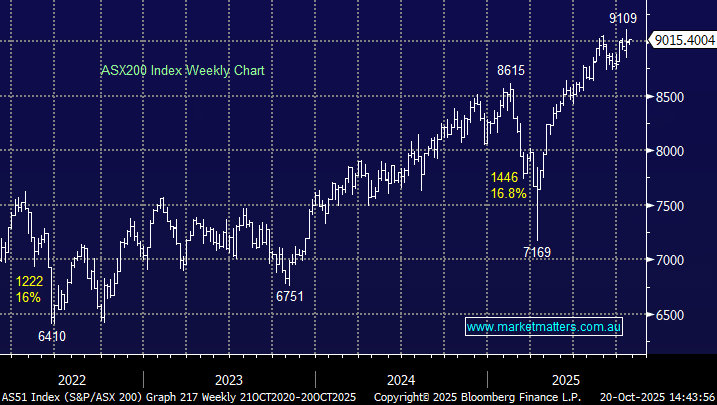

The local market has been anchored to the 9000 level since late August, with investors appearing comfortable to rotate between stocks and sectors, as opposed to committing/removing funds from the overall market. With the materials sector still up over +12% for the last month compared to an almost -4% drop by the consumer discretionary names and more than -6% drop by the local tech stocks, it’s easy to envisage some ongoing rebalancing, compounding some of the rotation we saw on Monday.

- While MM remains in “buy the dip” mode at the index level, we continue to believe the real action into Christmas will unfold on the stock and sector level – the ideal environment for “Active Investors”.

Overseas markets enjoyed a strong start to the penultimate week of October, thanks to a ~4% rise in Apple shares, following a broker upgrade, accompanied by broad-based buying with 9 of the main 11 sectors advancing by ~1%, or more. The S&P 500 ended up +1.1%, bested by the NASDAQ 100, which fared slightly better, closing up +1.3%. In Europe, the German DAX led the line, ending the session up +1.8% while the EURO STOXX 50 also enjoyed a strong session, finishing up +1.3%.

- The SPI futures are calling the ASX200 to open up +0.5% this morning following the impressive night on Wall Street.