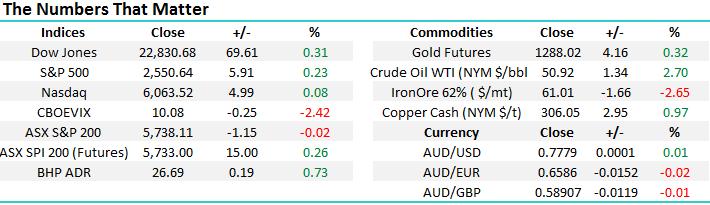

We remain comfortable with our ASX200 +6000 Call in 2017/8 (STO, RRL, ALL)

The local index remains fairly quiet with few short term catalysts to hang ones hat on, however a number of stocks in our portfolios are seeing some action. The gold stocks were up yesterday after the WA liberals blocked Labor’s plans for higher royalties while there is some corporate activity playing out in the property sector with Centuria (CNI) being the target of a share raid which pushed shares up by ~7%. We’ve also had the listing of the MCP Listed Income Trust (MXT) on Monday with the security putting on +4% on the issue price. More on both of these stocks in the Income Report today.

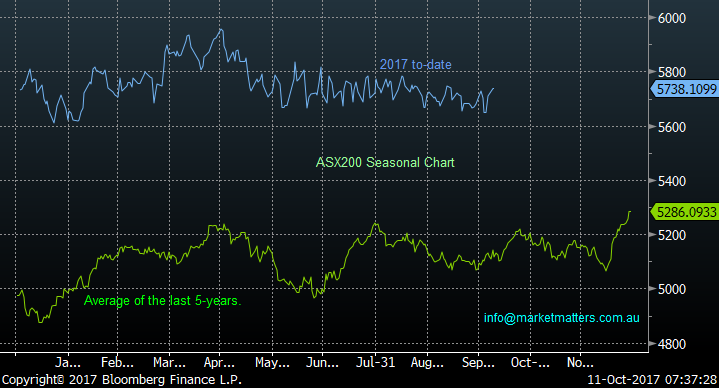

Back to the local market, and we remain hopeful that the last 21-weeks of index inactivity is not going to last into 2018. We think it’s unlikely - just a quick glance at the monthly ASX200 chart below illustrates that a move is overdue. However overall we still believe the main game in town over the coming months will be stock / sector rotation i.e. much more active than we were a few years ago – see our piece at the end of the report titled “Horses for courses”.

We’ve been looking for a spike down towards 5500 to give the market a springboard to rally into Christmas but so far any weakness in stocks has been met with decent buying from the largely underweight fund managers. While this scenario remains our ideal outcome from a risk / reward basis we will continue to accumulate individual stocks who weaken into our buy zones, simply in case a broad market pullback does not eventuate. Seasonally October is usually solid for Australian stocks, even taking into account the “87 crash” and the GFC, but considering we did not get the usual August – September drift lower any potential gains may be below par. Newsletters are already quoting the historically strong performance from our banks into November’s dividends but we caution on getting too excited short-term because the sector has already rallied in September compared to its usual fall i.e. we are happy to be long / overweight banks but the optimum buying levels may be behind us.

The US market continues to make all-time highs as this huge but very unloved bull market is close to notching up its 9th year. As I’m sure most know by now, this is the second longest bull market in history. We are certainly very conscious of this fact however at this point, it’s worth reiterating some simple views on why it’s too early to get off the train and move aggressively into cash / more defensive positioning:

- According to the respected Bank of America fund manager survey global fund managers have their lowest allocation to US stocks in nearly a decade.

- Their appears to be both decent cash levels on the sidelines and hedge funds are net short.

- Global economic data, led by the US remains solid and the trend is actually improving. The IMF overnight upgrading their global growth forecasts to 3.6% for 2017 and 3.7% in 2018

- US company profitability are being revised higher with quarterly reporting starting tomorrow in the US - this should provide more evidence of this.

Simply too many people are bearish stocks, just read the papers, in our experience the bears need to be silenced before stocks will fall. Interestingly not since the year prior to the GFC have global fund managers turned their back on US stocks so aggressively, we believe the patient will probably be rewarded but some short-term concern with this negative view feels very likely. For MM to get bearish and start significantly reducing our market exposure we want to see some euphoria / optimism out there and a rally by the ASSX200 to multi-year highs above the psychological 6000 area might just do it!!

ASX200 Monthly Chart

ASX200 Seasonal Chart

Global Markets

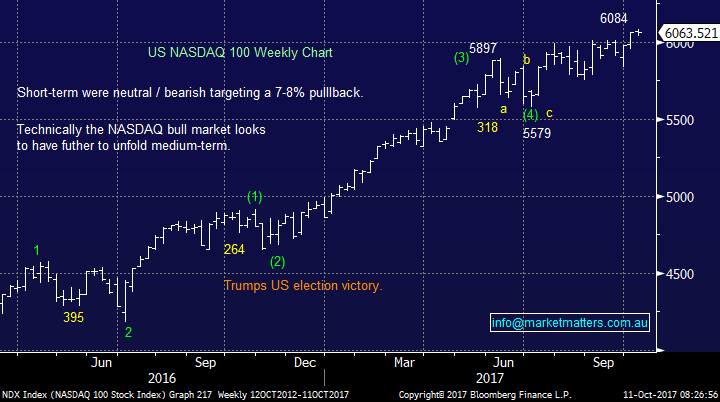

US Stocks

Last night the broad based S&P500 closed up 0.2% around its all-time high, we remain concerned around the current complacency within the US market but stress no sell signals have yet materialised. There is no change to our short-term outlook for US stocks, ideally we are targeting / need a ~5% correction before the risk / reward will again favour buying this market.

US NASDAQ Weekly Chart

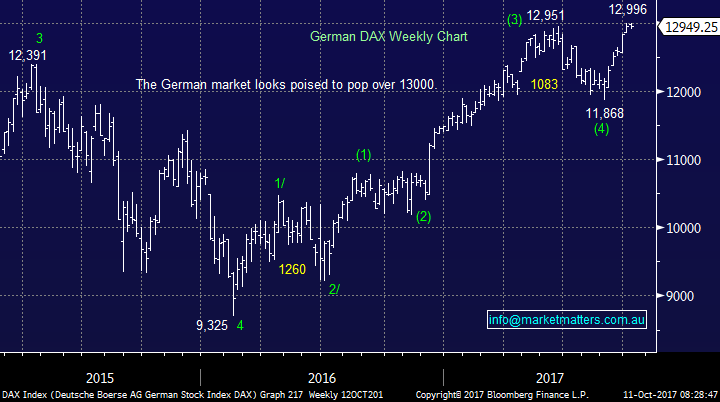

European Stocks

No change, European stocks look poised to make further fresh 2017 highs in the next few days but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Asian Stocks

The Hang Seng remains strong, especially after enjoying the 4.8% advance over the last 2-weeks but we continue to believe this 28,000 area will be a magnet for the market over coming few weeks at least

Hong Kong’s Hang Seng Weekly Chart

Horses for courses

In our opinion the global bull market is maturing fast and while it may last 9-years we don’t believe it will hit the decade milestone. Hence MM is instigating a mixed batch of investments from a style / timeframe perspective. Importantly they should all be evaluated in the context to how they were instigated. Today we are going to update our thoughts around the last 3 positions initiated over recent weeks to ensure subscribers understand our plans.

Aristocrat (ALL) $22.08

We bought ALL on the 28th of September at $20.55, currently the position is showing a nice 7.5% return. However our target is the $25 area, another 14% higher, hence its unlikely MM will be selling ALL in the near future.

Aristocrat (ALL) Monthly Chart

Regis Resources (RRL) $3.87

MM bought RRL on the 4th of this month at $3.66 and is currently almost 6% ahead. We are only looking for an advance towards the $4 area hence we may easily exit this position in the coming weeks.

Regis Resources (RRL) Weekly Chart

Santos (STO) $4.04

MM bought STO on the 4th of this month at $3.95 and is currently just over 2% ahead. We are looking for an advance towards the $4.50 area, around 10% higher, hence we may be still in this position into Christmas..

Santos (STO) Daily Chart

Conclusion (s)

We remain happy to increase our market exposure into weakness but see no reason to chase stocks at current levels.

We continue to believe the ASX200 will breach 6000 in the coming months.

Overnight Market Matters Wrap

· US markets firmed to set record highs again overnight as consumer stocks rebounded and investors focused on the upcoming quarterly reporting season.

· The oil price also rebounded strongly, leading the broader commodity index higher - notably the copper and gold prices after the IMF upgraded global growth, now forecast at 3.6% for 2017 and 3.7% in 2018.

· Iron ore, however, once again weakened to US$61/t., but both BHP and RIO recovered some ground from the previous night’s selloff. The A$ firmed to just under US78c.

· US reporting season kicks off tomorrow night with the US investment banks up Morgan, Citigroup and Bank of America among the first to report.

· The December SPI Futures is indicating the ASX 200 to open 18 points higher, above the 5750 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here