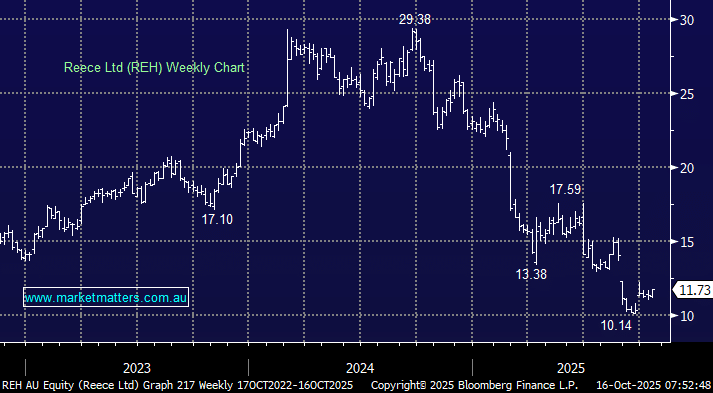

Plumbing business REH has been under significant pressure over the last year including a recent sharp drop in August after they delivered a weaker-than-expected FY25 result. However, a $250m off-market buyback with flexibility for up to $400m as part of its capital management strategy, announced in September, has helped stabilise the stock around $11-12 – at least they’re buying back stock at depressed prices! The buyback importantly illustrates management is comfortable with the company’s balance sheet.

The key to REH at the moment is the lacklustre performance of its US operation, which contributed 57% of its revenue in FY25. However, James Hardie (JHX) has bounced over 10% in recent sessions after releasing preliminary Q2 FY26 results that point to the start of a turnaround in its North American business, a great read through for REH, which is increasingly linked to the U.S. construction industry, primarily through its wholesale plumbing and waterworks distribution operations.

The stock is trading ~25% below its average last 2 and 5-year valuation, improving the risk/reward with plenty of disappointment baked into the current share price.

- We like REH here, as the US gets used to Trump and tariff uncertainty, the construction sector should improve, helping REH into 2026.