- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

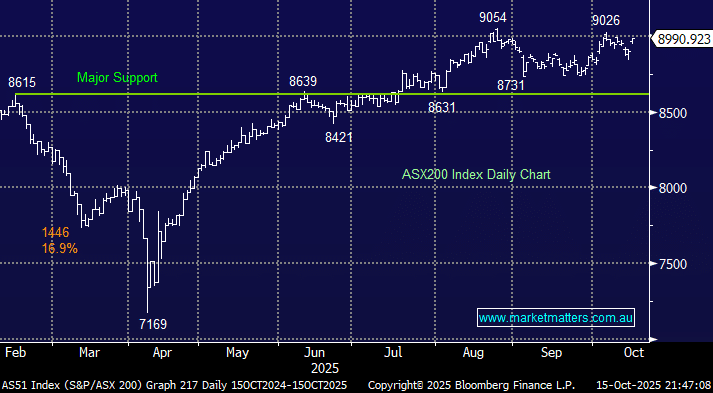

The ASX 200 climbed back toward the 9,000 mark on Wednesday, with strength across the banks and miners lifting the market to a second straight day of gains, with gold notching yet another record high. Banking stocks’ return to form came after a strong start to the US earnings season from some of their peers. Ten of the eleven local sectors ended higher, led by bounces in the healthcare and financial sectors, and continued strength in the materials sector, which notched a record close for a second-straight session. There was also some noticeable reversion both within sectors and on a stock-to-stock level, several of which we will look at later in todays report.

The Bank of America Fund Managers Survey for October came out this week and delivered some insight as to why we may be seeing some such rotation crossing our screens:

- Global fund managers are the most bullish since February, and stock allocation has climbed to a six-month high.

- Cash levels have dropped to just 3.8%, their lowest since 2024, illustrating a strong “risk-on” bias.

- However, a record 60% of fund managers now say global equities as a whole are too expensive and AI-related assets are in a bubble.

- Not surprisingly, “long gold” was named as the most crowded trade.

If you put the above four points in a mixing bowl, it’s not surprising that investors took some money off the table in the top performers, switching to the laggards in search of value while maintaining a net bullish exposure to the market.

Overseas markets were mixed overnight, with Wall Street’s failure to hold onto early gains catching the eye. In Europe, the French CAC rallied +2% while the German DAX closed down 0.2%. In the US, the S&P 500 closed up +0.4% supported by a bounce in tech stocks, with the NASDAQ ending the session up +0.7%.

- The SPI Futures are calling the ASX200 slip 0.1% early this morning while BHP was flat in the US.