The ASX200 is set to open sharply lower this morning with the high-flying miners likely to bear the brunt of the selling as fears that another period of tariff uncertainty will lead to a global slowdown. Most MM portfolios are positioned with fairly elevated cash levels, skewing us more towards the buy camp into weakness, however, as with anything related to Trump and China, there is uncertainty around how this could unfold. While we believe that both superpowers ultimately want to do a deal when/if they meet, we’re now in the early stages of posturing ahead of the face-to-face negotiations – both want to come from a position of strength.

It’s a tricky one, given how the far the market has rallied, and now President Trump and President Xi Jinping are set to heavily influence the path for stocks through October. The market feels vulnerable to us short-term around all-time highs, hence we’re likely to be patient before stepping up and allocating available funds into stocks – at least for the next few days to see how the dialogue progresses.

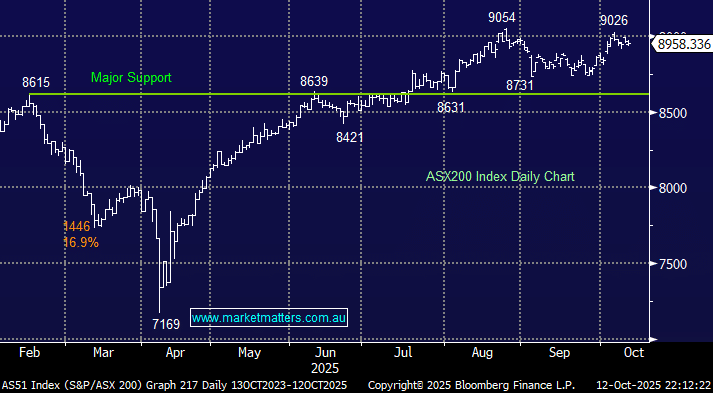

- The SPI Futures are calling the ASX200 to open down 0.9% this morning, well below 8900.