- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

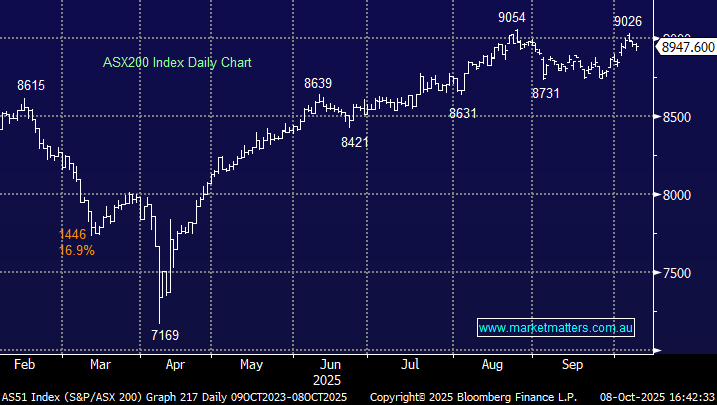

The ASX200 slipped 0.1% on a quiet Wednesday, which saw some initial morning weakness before buyers returned, taking the index back towards unchanged. Outside of Wesfarmers (WES) -7.5 points and James Hardie (JHX) +5.7 points, none of the main board added or retracted more than 2 points from the index. The main news on the day was gold surging through $US4,000 and the RBNZ cutting rates by 0.5% but again neither had as much impact as would often be expected:

- Gold’s strength had surprisingly little impact on gold stocks during the day, with Vault Minerals (VAU), Bellevue Gold (BGL), and Perseus Mining (PRU) all falling over 1% while heavyweights Newmont Corp (NEM) and Northern Star also closed lower.

- The RBNZ’s bumper 0.5% rate cut caught traders off-guard, with consensus at 0.25%. The Kiwi initially fell 1% against the $US dollar before bouncing, while the NZ share market closed up +0.3% after surrendering most of the day’s gains in the last hour.

As we mentioned in yesterday’s Match Out Report, the retailers struggled despite the RBNZ rate cut and a research note from UBS saying the retail spending remains firm. The sector has advanced more than 20% over the last six months, and it feels to MM that some fund managers are taking some money off the table as the path of the RBA gets more cloudy every time Michele Bullock speaks. The Materials Sector has been the main beneficiary of late, from gold to copper and even lithium stocks, they’ve all enjoyed recent weeks.

Overseas markets were again firm overnight, with sellers conspicuous by their absence. In Europe, the German DAX advanced +0.9% and the UK FTSE +0.7%, with the latter again posting new highs. In the US, the tech-based NASDAQ led the line, gaining +1.1% while the broader-based S&P 500 closed +0.5% higher.

- The SPI Futures are calling the ASX200 to open up +0.4% this morning, aided by a 50c gain by BHP in the US.