Activity has hotted up over the last 24 hours in credit markets with yields increasing in Japan and Europe following the political changes. However, bond investors have largely ridden a profitable playbook this year, enjoying wins on Federal Reserve interest-rate cuts and tumbling short-term US yields.

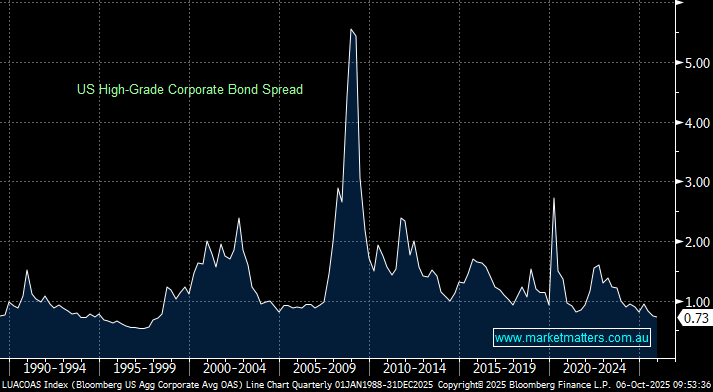

Now, they’re starting to look out a little longer on the Treasury curve. A cluster of bullish option trades has emerged over the past two weeks, wagering that a rally in 10-year US Treasuries will drive the benchmark below 4% for the first time since April, a move that would be further supportive for stocks. With corporate bond spreads the tightest since late 1990, with strong demand outweighing the wave of new issuance, it’s not surprising that longer-dated govt debt is being revisited.

- While most companies can borrow “cheap” money, equity markets should remain well-supported.

- The bond spread measure the additional risk premium investors require to hold corporate debt relative to safer US Government bonds.