- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

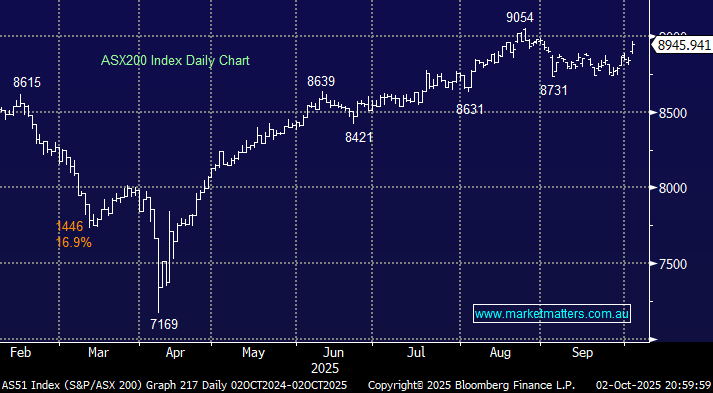

The ASX 200 surged +1.1% on the second day of October, enjoying its best session in six weeks, as the market appeared to enjoy fresh funds flowing into the major stocks and sectors. Gains took the index back within striking distance of its all-time high as the influential financials and miners lifted the broad market, with 8 of 11 major local sectors closing higher, with energy stocks, real estate plays and health care also notching gains of more than 1% each. In hindsight, we nailed it yesterday: “With US stocks having now strung together four positive days, notching new highs along the way, some performance catch-up by local stocks wouldn’t surprise as we start the new quarter.” However, we weren’t thinking of a triple-digit move!

- Such aggressive, broad-based buying of the majors, especially at the start of a month/quarter, is often a sign of overseas flows, an exciting prospect into Christmas.

At MM, we’ve remained bullish on the likes of ANZ and Westpac through 2025, and with both firmly on track to post new 2025 highs into their November dividends, the ASX200 also looks destined to post new highs before Christmas. Similarly, there’s no reason to doubt that the miners cannot maintain last quarter’s bullish advance. Hence, we’ve migrated our short-term view to bullish after the market’s recent 4-week consolidation.

Overseas markets were quiet overnight with little news flow to excite investors. In Europe, the German DAX gained +1.3%, and the French CAC +1.1%, following the positive path drawn by the ASX on Thursday. In the US, the small-caps outperformed, closing up +0.7% while the S&P 500 limped to a +0.1% gain.

- The SPI Futures are calling the ASX200 to open marginally lower following the quiet session on Wall Street. BHP Group (BHP) traded up 10c in the US.