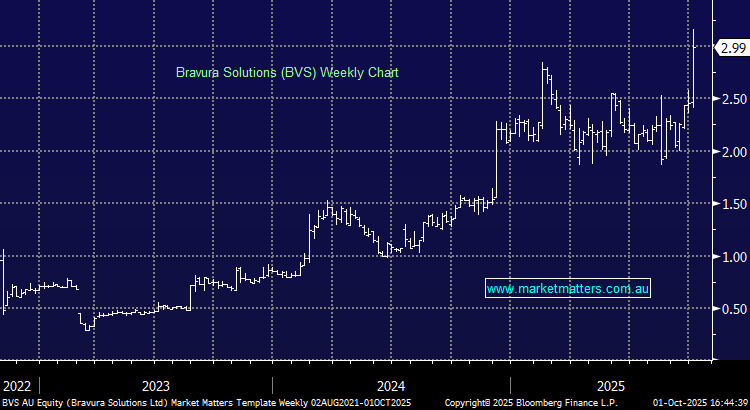

BVS +18.18%: surged to the highest since August 2021, after the Australian wealth management software provider raised its earnings guidance.

- BVS now expects cash Ebitda to be between A$55m and A$65m for FY2026 versus “at least A$50m” previously.

- The bump up is driven by strength of the GBP currency, and higher project revenue, particularly from wealth customers in Europe and the Middle East

This has been a great turnaround in recent years, and the business is clearly in the right track, though we think the bump up above $3 now sees the stock fully valued in the near term. We took a loss on BVS back in 2022 around today’s prices – before the stock fell away to 26c in 2023.