Hi Darren,

Netflix has been on an interesting journey over the years, it currently holds more than 20% of the global market, and closer to 25% in Australia. The sheer number of estimated subscribers illustrates the way that such subscription services are now regarded by many as necessity, almost like a mobile phone!

- Netflix – +300mn subscribers, Amazon Prime +200mn subscribers, Disney+128mn subscribers, HBO Max/Warner +126mn subscribers and Tencent Video +117mn.

Interestingly everybody in the MM office uses NFLX while they have been cutting back on some others, a bit like an unused Gym membership. This certainly suggests NFLX has some pricing power up and to a point, and it’s one of the best positioned streamers in terms of being able to raise prices and retain subscribers. In many markets, it appears able to implement small/medium price hikes regularly and still grow. Also, its move into ad‑supported plans helps soften the blow for price‑sensitive customers.

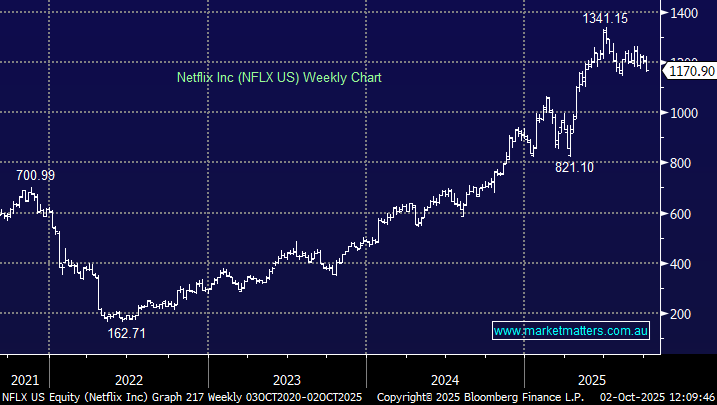

However, even with password-sharing crackdowns, growth in mature markets like the U.S. is slowing due to saturation and rising competition. Hence the stock is now trading on 45x, only slightly above its 5-year average valuation while much of the market is far richer with the S&P 500 trading at all-time highs.

- We think NFLX looks “ok” moving forward but it’s’ not in our sights at this stage.

From a technical perspective the stock looks tired above $US1200 as it steadily underperforms the broader market.