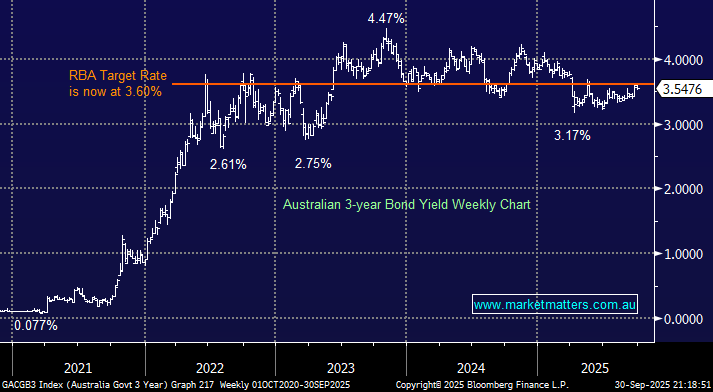

Local yields climbed on Tuesday albeit slightly, after more hawkish remarks from Michelle Bullock, reinforcing doubts about the pace of future rate cuts. Another RBA move before Christmas is now viewed as a coin toss, with markets pricing in just one cut over the next 12 months, with the timing of which remains the key point of debate. The $A traded up more than +0.5%, confirming the market’s diminished confidence toward RBA rate cuts into and through 2026.

- We can see the local 3s eventually testing the 3% area in 2026, but the economy will need to soften first.