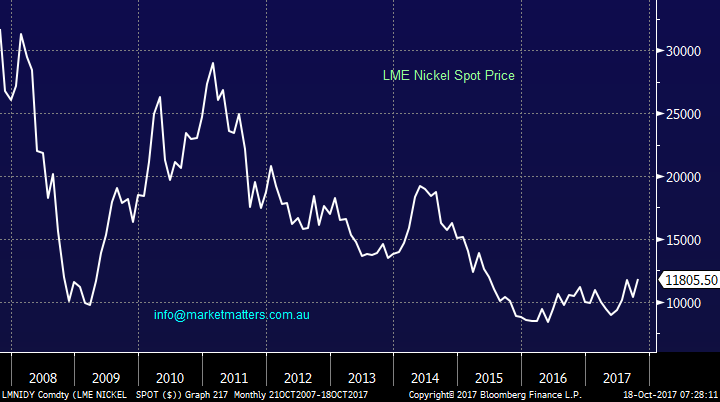

Are BHP right with their Nickel view? (BHP, IGO, WSA,TLSA, RIO)

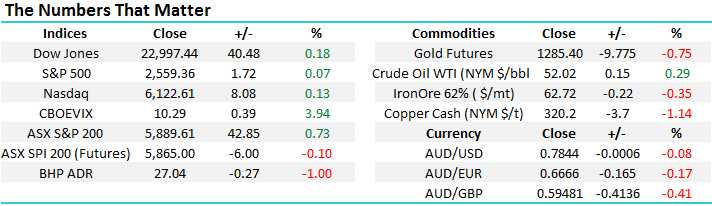

The ASX200 certainly feels like someone has lit a fuse under the powder-keg of the buyers following a 245-point / 4.3% rally in just 8-days, while over the same period the US S&P500 has gained only 0.4%. As we pointed out a week ago the strength has been very broad based which is usually a very bullish indicator e.g. over the last 5-days all the sectors of the ASX200 have advanced solidly with Telco’s the best at +6.6% and Real Estate the worst at +1%. The only missing ingredient to tick all the bullish indicators is the lack of volume but this feels down to the distinct absence of selling similar to what we often witness around Christmas which usually leads to an aggressive rally.

Obviously the picture for the ASX200 has now evolved with only our forecast of a break over 6000 in 2017/8 remaining firmly intact – our best guess on this would be ~6200 but we will refine this moving forward. Some important levels to watch, especially if we do see some weakness in overseas markets.

- We are now firmly bullish the ASX200 assuming it remains above 5810 and especially 5755.

- For now the traders should be looking to buy any 50-point correction with stops under 5810.

We are close to a seasonally average / poor time for local stocks and we would not be surprised to see it coincide with an overdue pullback in global equities. However we feel the local market has now shown its bullish hand and we expect outperformance from local stocks as investors who have missed the recent rally quickly put their hands up to buy any dips.

We remain comfortable holding 14% of the MM Growth Portfolio in cash looking to tweak around the edges for optimum performance e.g. buy Macquarie (MQG) under $92 and sell Regis Resources (RRL) over $4.

ASX200 Daily Chart

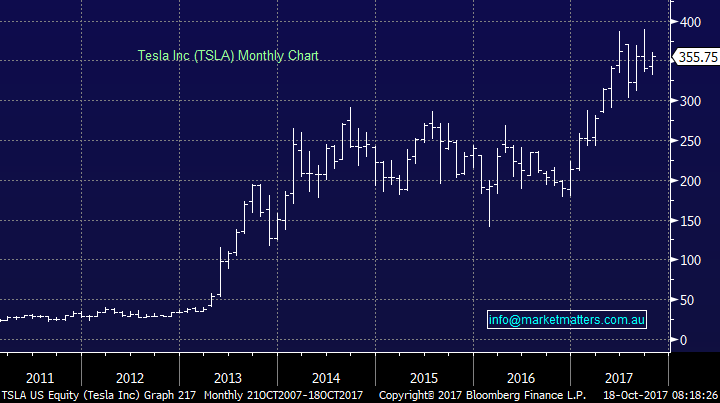

Nickel moving forward

BHP came out yesterday and said they believe there is going to be a battery boom and the battery-driven demand for nickel is accelerating so fast that it may step-up the 2nd stage of its major nickel sulphate plant. Unfortunately as we all know BHP have not got a great track record of being ahead of the curve within the commodity cycle over the last decade with its share price down a massive 43% from this time 10-years ago. I don’t want to harp on this point however, I was sitting in a meeting with Andrew McKenzie when Iron Ore was around ~$30 and his prediction was lower for longer, and they were preparing their business for Iron Ore sub $40 for an extended period. Recently, and before the recent 25% decline in Iron Ore they expected price stability – so clearly, we should be under no illusion at their ability, or lack thereof to predict commodity prices.

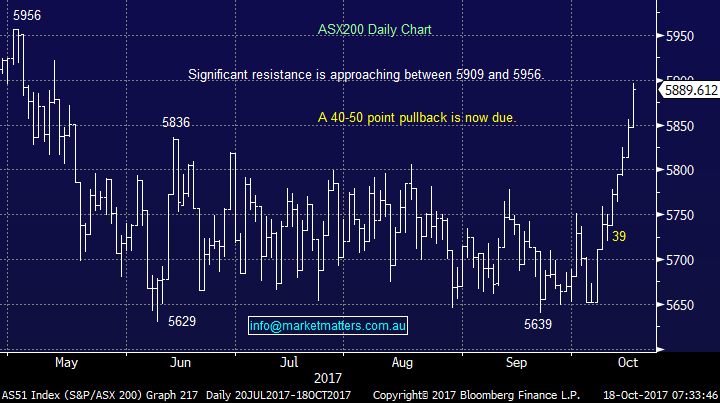

That said, I tend to feel investors would need to have their head in the sand not recognize the trend towards battery powered cars and potentially the whole home – just look at the following chart of Tesla which still losses millions and millions a week i.e. it’s a graph all about potential future earnings (promises of riches) and development of technology that Hamish Douglas from Magellan would say will lead to ‘exponential growth’!

Tesla US Monthly Chart

Although we don’t proclaim to be experts in battery power clearly we need to be very conscious of the prevailing trends playing out, hence todays focus on Nickel. To give a brief background, the most widely used rechargeable battery-based systems employ nickel-cadmium (NiCd), nickel-metal-hydride (NiMH), lithium-ion (Li-ion), or Li-ion polymer, though silver-zinc batteries are now emerging. NiCd batteries were the first widely used battery for portable equipment. Elon Musk (Tesla CEO) recently commented, “our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide… [there’s] a little bit of lithium in there, but it’s like the salt on the salad.”

Despite these positive trends, the underlying nickel price remains down over 50% from where it was prior to the GFC hence while global production is gearing up for the potential battery led boom it does feel just on a cycle basis that the nickel has plenty of room to catch up with the likes of copper and aluminium who have outperformed the major battery component since the early 2016 recovery in metals commenced.

LME Nickel spot price $US / MT.

We have written about base metals as a whole recently with a clear bullish bias which ties in with the MM belief in the reflation trade – the base metals index below comprises aluminium, copper, nickel and zinc and its breaking up! Hence the important question today is can we see value in the Australian nickel space?

Base Metals Index Monthly Chart

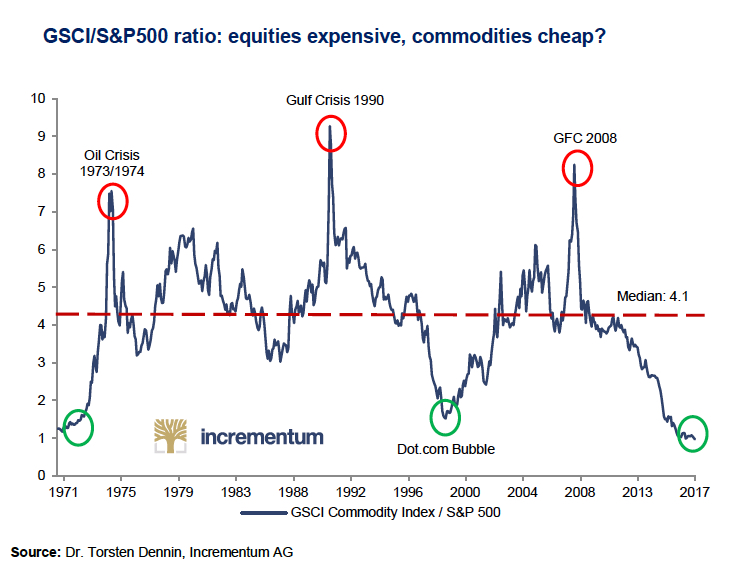

Quickly again look at the below chart we showed last week, when we look at the commodities versus the S&P500 it feels like something is going to break. As they say a picture tells a thousand tales.

We have 2 standout companies within the nickel space in Australia and both look strong at the moment which is great news considering we like the base metals sector.

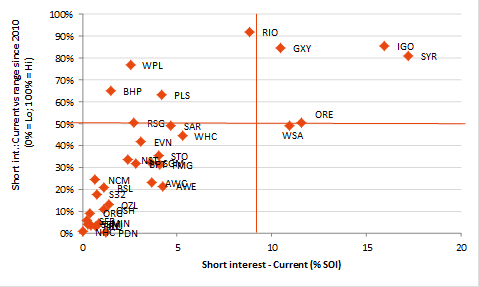

1 Western Areas (WSA) $3.13 – WSA has smashed the large short position over recent weeks which is usually not an ideal time to purchase a stock but WSA looks bullish in a sector we like initially targeting $3.50 plus there remains a short interest of 10.95% making it the 8th most shorted stock on the ASX. It seems to us that this capitulation of shorts towards the sector is the first sign of more ‘positive vibes’ around the Nickel plays. The issue though with short covering is that its artificial buying, or in other words, buying stock because one has become less negative more so than becoming net positive. On the 4th Aug there were 58m shares held short while now there is around 29m – a halving of outstanding short positions. That means that 29m shares have been bought back over 57 trading days, or an average of around 500,000 shares covered each day versus an average daily volume of 2.6m shares – so ~20% of the buying has been short covering.

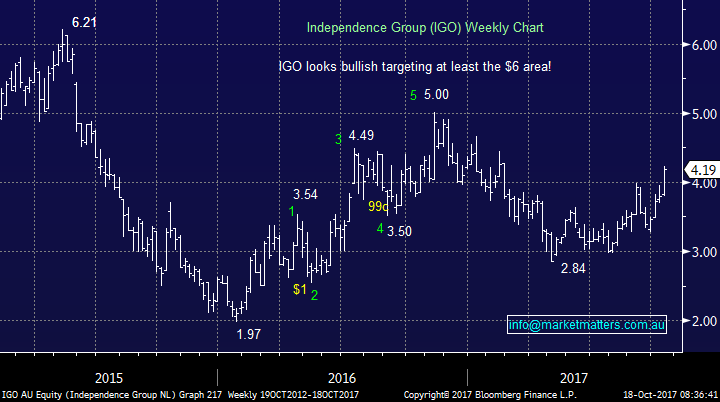

2 Independence Group (IGO) $4.19 - IGO is the second most shorted stock in the market at 15.9% of its register held short, although this is a Gold / Nickel miner, skewing more towards Nickel as time goes by. The market has been concerned about the ramp up of their Nova Nickel project however we think this concern is overinflated. In short, we simply believe the market is wrong on this stock, especially from a risk / reward perspective.

Simply we like both of these companies and can see ourselves accumulating in the near term.

Western Areas (WSA) Weekly Chart

Independence Group (IGO) Weekly Chart

Another interesting chart from Peter O’Connor from Shaw covering Short Interest in the sector. RIO has its biggest short position since 2010 at 9% of shares.

Current Short Interest vs average since 2010

Source: Shaw and Partners, Factset

Global Markets

US Stocks

Last night the broad based S&P500 again closed up +0.1% continuing to hover around its all-time high, we remain concerned around the current complacency within the US market but stress no sell signals have yet materialised.

There is no change to our short-term outlook for US stocks, ideally we are targeting / need a ~5% correction before the risk / reward will again favour buying this market.

US NASDAQ Weekly Chart

European Stocks

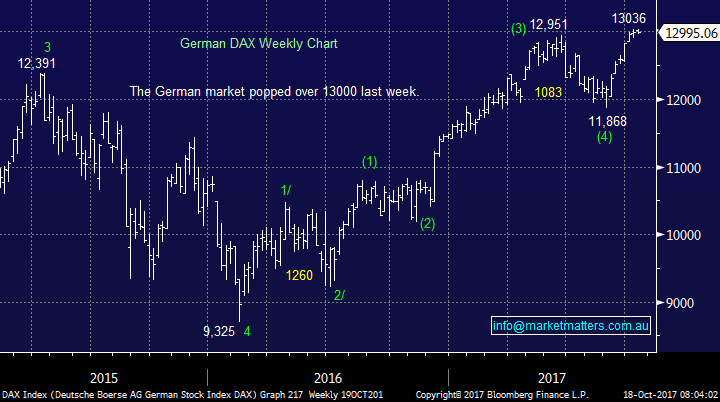

No change, European stocks have now made the fresh highs as anticipated but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Asian Stocks

The Hang Seng remains strong, especially after enjoying the 4.8% advance over the last 2-weeks but we continue to believe this 28,000 area will be a magnet for the market over coming few weeks at least

Hong Kong’s Hang Seng Weekly Chart

Conclusion (s)

We are keen buyers of the resources sector and especially the base metals moving forward with nickel stocks IGO and WSA firmly in our sights.

Our SELL alert on Regis Resources (RRL) at $4.00 or above still stands

Overnight Market Matters Wrap

· A marginal close to the upside was witnessed in the US equity markets overnight, as bets heightened following an anticipation of the next US Fed will lift its key interest rate in December this year.

· Gold continued to decline, as investors continue to switch to riskier assets, as did iron ore give some healthy gains back, off 0.35%.

· The December SPI Futures is indicating the ASX 200 to open marginally lower, testing the 5885 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here