Palantir Technologies makes software that helps organisations analyse large amounts of data to make better decisions. Its main products serve both governments and businesses for tasks like tracking fraud, managing supply chains, and planning operations. Over the past year, PLTR has delivered both impressive earnings growth and secured strategic partnerships, solidifying its position in the AI and data analytics sectors.

In 2Q25, PLTR reported a 48% year-over-year revenue increase, reaching the magical $US1bn. with the customer base increasing by +39%. The company’s operating margin was 46%, and adjusted free cash flow came in at an impressive $569mn. Also, PLTR has formed several key partnerships to enhance its AI capabilities with the likes of Boeing, Databricks, Deloitte and Bain & Company.

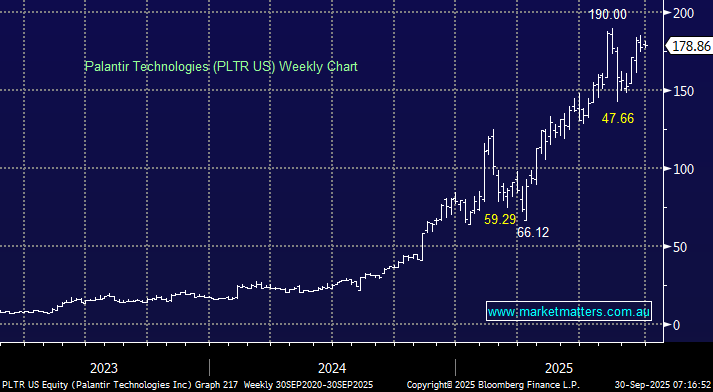

Palantir’s strategic focus on AI innovation and expansion into key government and defence sectors has positioned it for continued growth, with analysts projecting 41% YoY revenue growth in 2026 and a compound annual growth rate of 35% from 2025 to 2030. The issue is there’s already a lot baked into the cake, even though it tastes nice! If we see a value contraction-driven pullback, PLTR could again test $US150, where we would be interested.

- We can see PLTR testing $200 into 2026, but the risk/reward is average around $US180.