- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

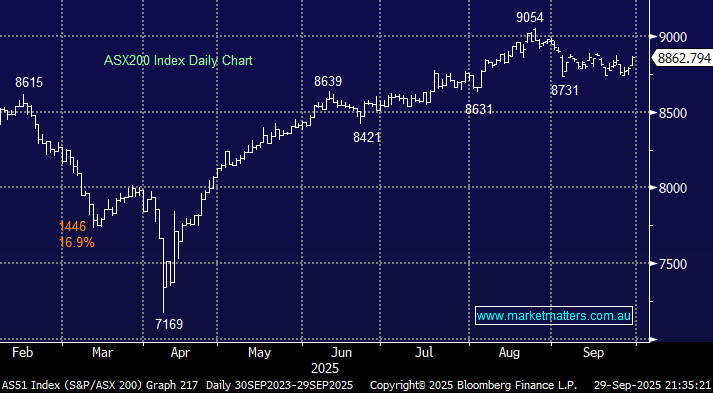

The ASX 200 put in a stellar performance on the penultimate day of September, advancing by +0.9% and reducing the month’s decline to 1.2% with just today remaining. Gains weren’t overly broad-based, with less than 60% of the main board closing higher, but when the “Big Four Banks” advance on average more than 1.8% the index is almost guaranteed to rally, and when it’s supported by the influential healthcare names, and a rampant gold sector, gains become magnified ultimately delivering the best day since September the 4th.

Markets delivered a mixed message on Monday, with Asian defence stocks rallying on heightened geopolitical tensions after President Trump urged NATO nations to shoot down Russian aircraft violating their airspace. The prospect of conflict escalation helped gold surge past US$3,800 to record highs, yet moves in the day’s leading sectors, financials, healthcare, and industrials, didn’t point to broader global risk aversion. Investors still appear more inclined to chase buying opportunities than heed reasons to sell, leaving markets feeling underweight “risk.”

- We remain keen “buyers of dips” as we enter the historically volatile October, a month where 5% swings have been commonplace over the last decade.

Overseas markets were firm overnight, although markets on both sides of the Atlantic surrendered much of their early gains. In Europe, the Euro STOXX 50 gained +0.1% while the UK FTSE closed +0.2% higher. In the US, the S&P 500 closed +0.3% and the tech-based NASDAQ +0.4%. The big moves were in commodity markets, with gold closing up +1.8%, and copper +2.9%.

- The SPI futures are calling the ASX200 to open up +0.2% this morning, aided by strong moves in the US by copper stocks and BHP, which closed up 80c.