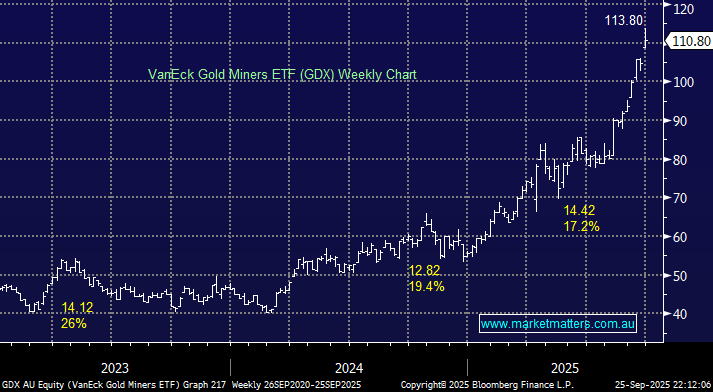

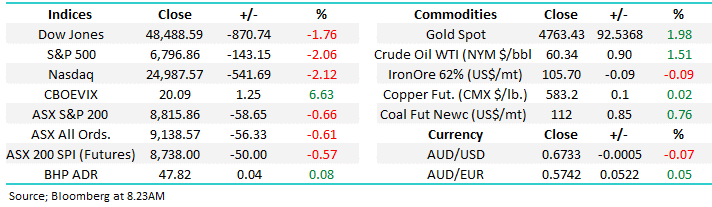

We continue to like the ASX-traded VanEck Gold Miners ETF (GDX) for broad-based exposure to global gold, or more precisely the NYSE Arca Gold Miners Index. The ETF has its largest holdings in North America, affording local investors some diversification. Currently, it holds 52% in Canada, 17% US and 11% Australia, followed by 7% in South Africa. The ETF costs 0.53% pa, while providing an excellent spread of gold exposure, which has performed strongly, advancing 88% over the last year compared to the index’s 87% gain.

Ongoing robust gold demand was illustrated overnight when Goldfields sold its $1.1bn holding in Northern Star (NST) at just a 2.7% discount to the last trading price.

- We like the GDX into dips with an ideal entry around $100.