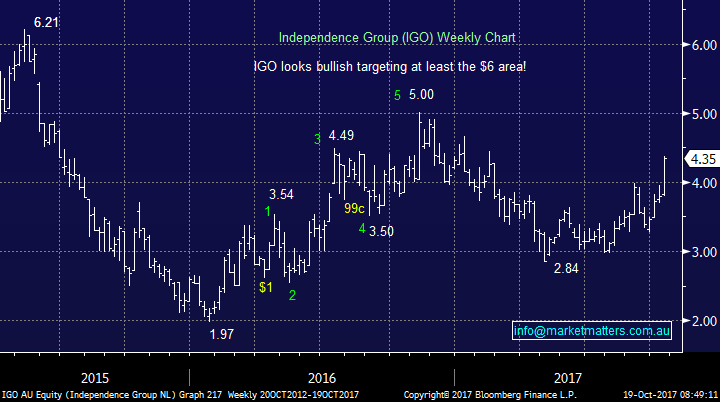

6 stocks firmly on our radar – both buying & selling (MQG, BHP, IGO, CGF, STO, CYB)

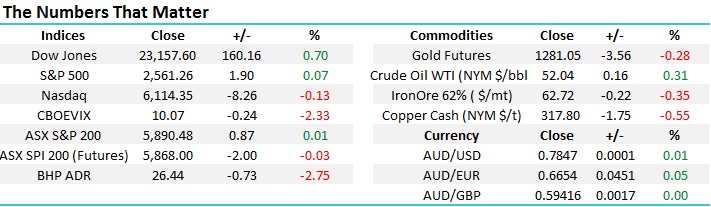

Yesterday the ASX200 extended its winning streak to 9 very impressive days but with the AFR currently leading with bullish titles like “ASX’s $100bn rally looks set to roll on” and “markets almost immune to bad news“ we think a pullback is probably about to commence, they simply have a great knack of being an accurate reverse indicator. We actually saw the market finally struggle into the close for the first time in ~10-days, only managing to close up 1-point, in the bottom quartile of the day’s trading range but winners did still trump losers by 99 to 85 i.e. the broad market remains solid. Weakness again returned to the telco sector following Telstra’s AGM – not only have the board performed an awful job of running the company, they are now talking down their own share price! Also some selling returned to the resources sector with BHP falling -0.5% and Fortescue (FMG) another -0.6% - today should be a big test here with BHP closing down 73c / 2.7% in the US compared to the local close of $27.17.

Importantly we want to reiterate our overall current bullish stance towards the local market:

- We are bullish the ASX200 and would need a break back under 5800 to negate this view.

- Short-term we expect some consolidation following the recent strong gains with 5850 the obvious target / support area.

- Medium-term we remain bullish targeting a significant break over the psychological 6000 area.

We finally managed to take a nice quick profit of just over +9% on our Regis Resources (RRL) position early yesterday afternoon with the stock hitting $4.03 before finally closing at $3.97 – at this stage we are happy to sit on the sidelines with RRL but will be keen buyers at lower levels ~$3.25. The MM Growth Portfolio is now sitting on a fairly hefty 17% cash position but with stocks like Crown (CWN) – 4.3%, Altium (ALU) -6.3% and Lend Lease (LLC) -10.5% taking large intra-day hits some good opportunities do not feel too far away – hence the title of today’s report.

ASX200 Daily Chart

3 stocks we are looking to buy

It’s fun for us at MM writing interesting / thought provoking reports on macro and global themes but occasionally we must focus on specifics as stocks we own / or are considering buying present opportunities and without focus / preparation they can pass us by very quickly. Hence today we are simply looking at 6 such situations - 3 buy and 3 sells which the MM Growth Portfolio is watching / considering very carefully.

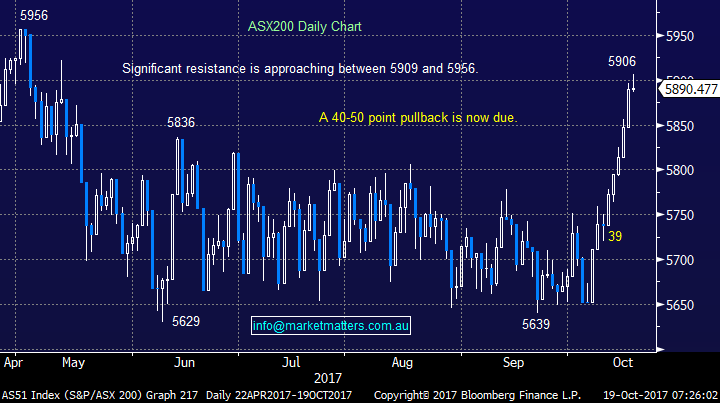

1 Macquarie Group (MQG) $92.93

No change with our targeted buy level for MQG sub $92 and with stock marginally lower over the last 5-trading days, ignoring the strong gains by the local market, we are reasonably optimistic of an opportunity presenting itself.

Macquarie (MQG) Monthly Chart

2 BHP Billiton (BHP) $27.17

There is no major change here except this morning’s likely significant gap lower by BHP will bring our targeted buy area back into play.

We are buyers of BHP around the $25 area – note as we have outlined in previous reports we also like other stocks within the sector hence will potentially be buyers of similar stocks into some weakness e.g. RIO and OZ Minerals.

BHP Billiton (BHP) Weekly Chart

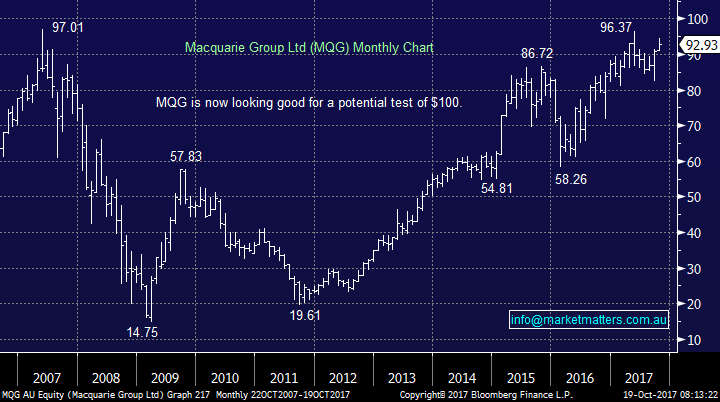

3 Independence Group (IGO) $4.35

IGO looks great technically and we like the nickel story as was outlined yesterday plus the huge short-position is very appealing from a squeeze perspective.

We can buy around current levels with stops under $3.78 for the aggressive players.

Independence Group (IGO) Weekly Chart

3 stocks we are considering selling

4 Challenger (CGF) Ltd $13.64

Our profit target of ~$14 has happily come into play far faster than was expected however we will be sticking to our plan and at this stage will be taking profit over the coming days / weeks if the opportunity arises around $14.

Challenger (CGF) Monthly Chart

5 Santos (STO) $4.23

We are long STO as a short-term play targeting the $4.40 region, similar to RRL we will have no hesitation pulling the trigger when / if the stock reaches these level.

Santos (STO) Daily Chart

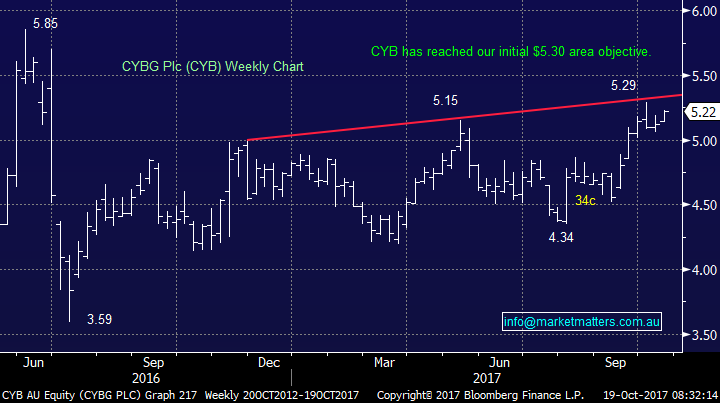

6 CYBG Plc (CYB) $5.22

We are still holding 5% of our portfolio in CYB with a target now just over $5.30 - last night CYB in London traded to fresh highs for 2017 gaining 0.9% so we may just get our opportunity sooner rather than later.

We are conscious of November looming, seasonally a weak period for our banking sector, hence reducing our significantly overweight exposure to the sector is obviously a consideration.

CYBG Plc (CYB) Weekly Chart

Global Markets

US Stocks

Last night the broad based S&P500 again closed up +0.1% continuing to hover around its all-time high, with an almost 10% gain by market laggard IBM sending the Dow surging and clearly assisting the overall sentiment.

There is no change to our short-term outlook for US stocks, ideally we are targeting / need a ~5% correction before the risk / reward will again favour buying this market.

US NASDAQ Weekly Chart

US IBM Monthly Chart

European Stocks

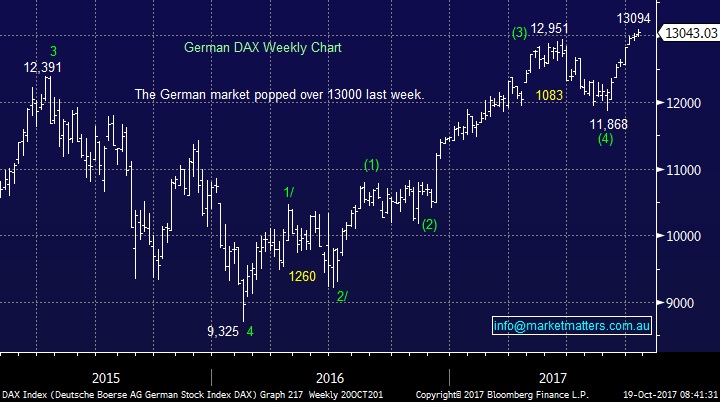

Yet again no change, European stocks have now made the fresh highs as anticipated but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Asian Stocks

The Hang Seng remains strong, especially after enjoying the ~5% advance over the last 4-weeks but we continue to believe this 28,000 area will be a magnet for the market over coming few weeks / months at least

Hong Kong’s Hang Seng Weekly Chart

Conclusion (s)

We are potential buyers of ; MQG, IGO and BHP.

We are potential sellers of : CGF, STO and CYB.

*Watch for alerts.

Overnight Market Matters Wrap

· The Dow Jones surged 0.7% higher overnight to a new record, while the S&P 500 and NASDAQ closed virtually flat as US housing starts and building permits for September were lower than expected.

· Chinese President Xi gave a 3 hour speech to the national Party Congress which will be scrutinised by the market. Chinese GDP and Industrial Production will be released at 1pm AEST today.

· Zinc bounced after yesterday’s fall while the rest of the metals on the LME closed in the red. Oil was better and iron ore closed down 0.4%.

· The December SPI Futures is indicating the ASX 200 to open with little change this morning at the 5890 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here