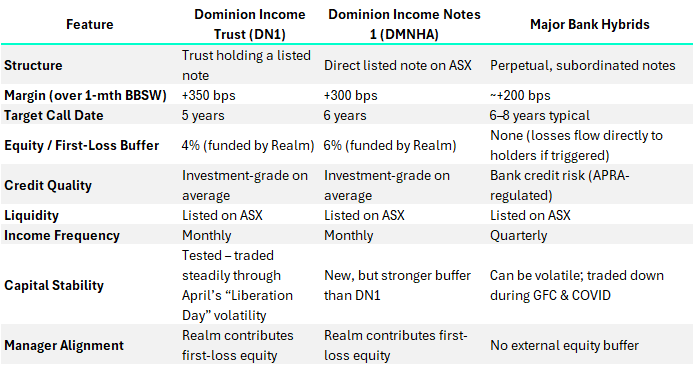

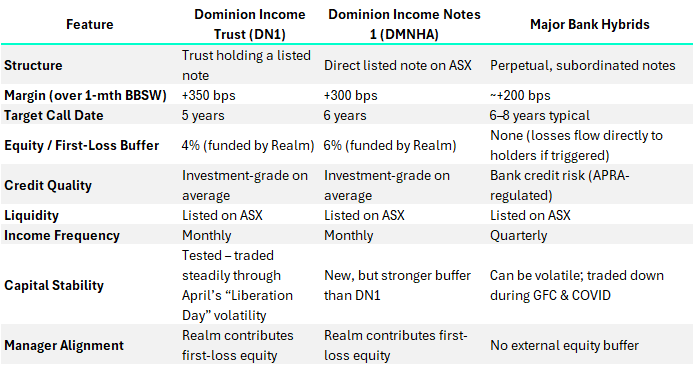

Realm Investment House has come back to the market with a new income security, following on from their listing of the Dominion Income Trust (DN1) in March 2025, which MM holds in our Income Portfolio. There are some commonalities between the existing DN1 security, and the proposed DMNHA, though there are also some clear differences, with the new issue being a slightly lower risk/return vehicle, structured as a listed note.

The notes are backed by a diversified portfolio of debt and credit-type instruments. Specifically:

∙ Debt securities, loans, trust interests, notes, and bank facilities.

∙ These may be held directly or via investment funds managed by Realm (and/or through other credit funds).

∙ The investment strategy is to originate or invest in those debt instruments issued by corporates, banks, and non-bank financial entities that have strong financial profiles, underwriting, and risk controls.

Realm’s first vehicle (DN1), which they issued under their wholly owned brand Dominion, we think is a good security. Credit portfolios are meant to diversify equity-heavy portfolios by holding a mix of more stable credit assets, however, one of the drawbacks of a Listed Income Trust (LIT) historically has been that they trade more like equities – often slipping to material discounts to net asset value in periods of stress. DN1’s structure addressed this issue by incorporating a first-loss equity buffer (funded by Realm).

This is essentially a first-loss tranche of capital contributed by the manager, whereby they commit an equity slice (around 6%) of the total capital structure. That means before noteholders take any losses, the equity absorbs them. If underlying loans or debt securities in the portfolio default, the equity is written down first. It works to align incentives, or in other words, the manager has “skin in the game” since their own equity is at risk before investors’ notes.

Let’s say DMNHA raises $100m total, $94m comes from investors (noteholders), and $6m is the equity buffer (manager’s capital). If the portfolio of loans suffers a $4m loss, that is absorbed entirely by the $6m equity; however, if the losses are, say $8m, the $6m equity is wiped out, and noteholders lose $2m (≈2% of their capital). Important to flag, the buffer does not replenish; if it’s eroded by losses, the protection shrinks, though it’s still a positive to have it there in any case. (If you required the manager to continually top it up, it would effectively be a guarantee, which would be a big ask).

Ultimately, we think this structure is appealing by delivering income with genuine downside protection, and with a yield that looks attractive relative to existing bank hybrids, we can understand why demand has been strong for this security.