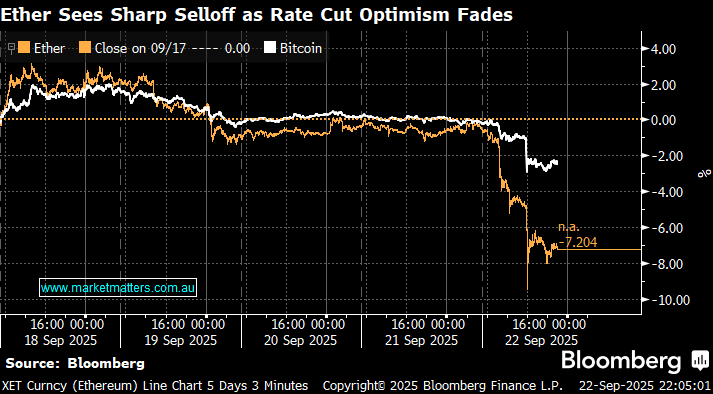

Crypto-linked stocks, including Coinbase Global Inc., dropped as cryptocurrencies sank after more than $1.5 billion in bullish wagers were liquidated on Monday. This triggered a sharp selloff that sent Ether and other tokens plunging. Ether fell as much as 9% to $4,075, and Bitcoin declined ~3% while coins like Solana, Algorand and Avalanche also dropped, perhaps the Trump family took some profit! It was the biggest wave of liquidations across cryptocurrencies since at least March, according to Coinglass data.

On Monday, more than 400,000 traders saw their positions liquidated over the 24 hours; the resulting selloff dragged the overall digital-asset market size below $4 trillion. Data from CryptoQuant show the funding rate for Ether perpetual futures, the fee paid between traders to keep leveraged positions open, has turned negative, hitting its lowest level since last year’s unwind of the yen carry trade. It’s an indication that short sellers are dominating and paying longs to hold their positions. The next 5-10% now feels likely to be on the downside as this “crowded” trade gets unwound.

- We are conscious that equities often follow cryptos, which are a great indicator of liquidity/risk appetite, adding a piece to the jigsaw puzzle in our neutral short-term stance.