- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX 200 finished +0.4% higher on a fairly choppy Monday, which saw a very strong local market opening, eventually losing half of the early gains. The gains were very stock/sector specific, with only 6 of the main 11 sectors closing higher, but a stomping +2.6% session by the materials stocks was enough to drive the market higher, with gold equities again the shining light with the precious metal breaking well above the $US3,700/oz milestone. The influential iron miners were also strong despite China’s state-run iron ore trader urging domestic mills to avoid one of BHP’s popular products – more on this later. The uranium-focused companies also did well, with Boss Energy (BOE) surging +6.8% and Paladin pushing 4.7% higher even after raising capital (placement shares are issued today).

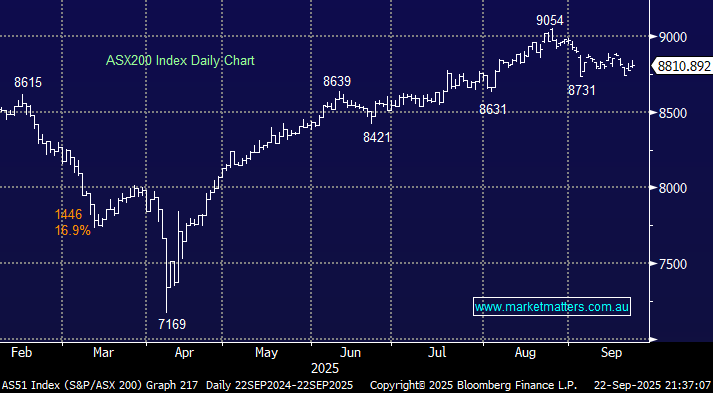

The ASX200 has now declined for the last three weeks, ignoring strong gains by the US indices, both before and after the Fed’s rate cut. The 8800 level continues to act like a magnet to the local index, although under the hood, stocks and sectors are running their own race. We wouldn’t be surprised by a reverse performance through the balance of September and into October, i.e. US indices finally have a pullback, but the ASX outperforms, often gapping lower before trading higher through the session.

Monday also saw Asian shares rise, with Japanese shares advancing after concerns about the Bank of Japan’s plan to offload its massive exchange-traded fund holdings eased. However, similar to the ASX, it finished well off its highs, up 1%. Cryptocurrency traders saw more than $1.5 billion in bullish wagers liquidated on Monday, triggering a sharp selloff that sent Ether and other tokens plunging – we’ll revisit this theme.

Overseas markets were mixed overnight, with US stocks remaining strong while it was a mixed affair across the Atlantic. In Europe, the German DAX closed down 0.5% while the UK FTSE closed +0.1% higher. In the US, a late rally saw the tech-based NASDAQ close up +0.6% and the broad-based S&P 500 +0.4%.

- The SPI futures are calling the ASX200 to open up +0.2% helped by a 25c rally by BHP in the US.