Gold has enjoyed a phenomenal run this year, and the majority of investors, fund managers, clients & advisers we speak with, remain very bullish. This bullish stance has foundation, underpinned by a long list of supporting factors:

- Markets are pricing multiple rate cuts as inflation moderates and growth slows, lowering the opportunity cost of holding gold.

- A weaker USD has further supported the metal, with gold typically moving inversely to the greenback.

- Persistent geopolitical uncertainty, particularly in Europe and the Middle East, has seen safe-haven demand remain elevated.

- Investors continue to view gold as a portfolio hedge against both geopolitical flare-ups and financial-market volatility.

- Emerging-market central banks remain large and consistent buyers, adding to reserves as part of broader de-dollarisation efforts.

- Institutional flows into gold ETFs and commodities funds have picked up meaningfully in 2025, as allocators re-engage with the asset class after a period of underweight positioning.

- Gold production growth remains constrained, with cost inflation (energy, labour, equipment) keeping supply tight. This adds a supportive layer to pricing in an environment of strong demand.

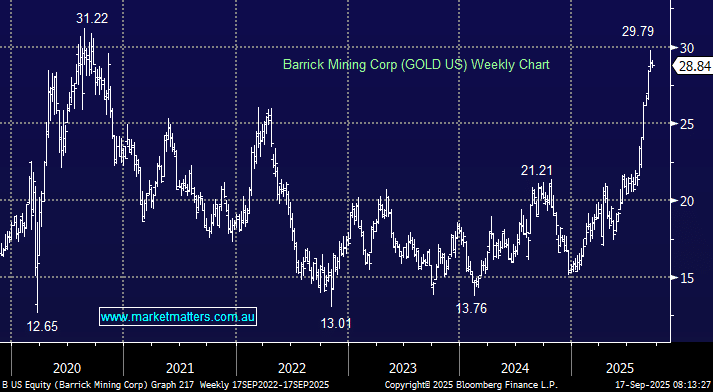

At Market Matters, we employ a top-down, meets bottom-up style of investing. Overall macro views feature heavily in our investment decisions, particularly when it comes to areas such as gold. We’ve recently flagged our more cautious short-term view on gold, and yesterday we sold Evolution Mining (EVN) from the Growth Portfolio.

While the above factors are clearly supportive of the price, none of them are new news – they’ve been in play now for an extended period, and quite rightly, this has propelled gold and gold equities to new all-time highs. Investor positioning is very important, and at MM, we now believe that positioning is incredibly one-sided, opening the door for greater negative reactions to any less favourable conditions, with tomorrow’s interest rate decision in the US a near-term risk.

- While the trend is still clearly up, in the short term, the risk/reward towards gold and gold equities has flipped based on universally bullish positioning – we think taking profits across our gold exposure now makes sense.