- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

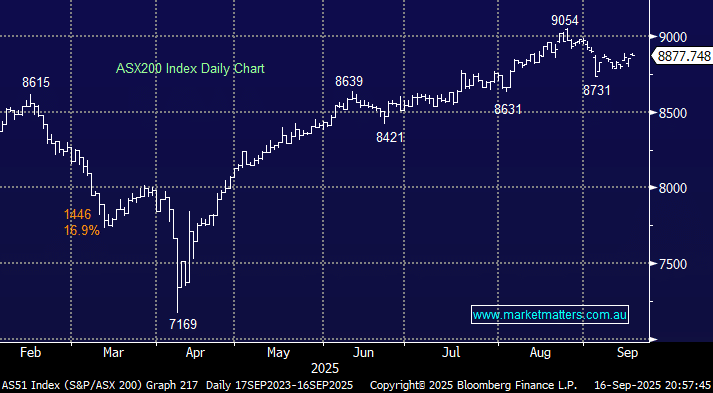

The ASX200 rose 0.3% on Tuesday, finishing mid-range in subdued trade. Uranium names powered the energy sector to the day’s best performance, while defensive healthcare and consumer staples lagged, each slipping 0.3%. Through 2025, we’ve heard the phrase “billionaires behaving badly”, courtesy of Wisetech and Minerals Resources – more on the former later in this report. On Tuesday, a successful CEO joined the cohort, although he didn’t manage to hold onto his position with Super Retail Group (SUL), firing its CEO/MD, Anthony Heraghty, following news of an undeclared workplace relationship. Shares in the owner of Rebel Sport and Supercheap Auto dropped 4.3%.

Global markets are jockeying for position, placing bets ahead of the Fed policy meeting. Remember, the 0.25% rate cut is fully expected; it’s the accompanying rhetoric which will determine the market’s reaction. Wall Street is rallying into this Fed decision, and it’s doing so on the expectation that there will not just be a rate cut, but guidance towards plenty more over the coming 12-18 months. It will be interesting to see how accommodating the Fed wants to be, especially under pressure from the president, without hurting the credibility of Jerome Powell & Co.

- The bull market is intact, but we’re conscious there’s a lot of good news factored into stocks at current levels.

Overseas markets retreated overnight as nerves set in ahead of the Fed meeting. A solid reading on US retail sales did little to influence trading, with equities losing steam near all-time highs and bond yields edging lower. The S&P 500 and tech-based NASDAQ closed down 0.1%. In Europe, indices were weaker, with the DAX falling 1.8% and the UK FTSE 0.9%.

- The ASX200 is set to open down 0.5% this morning following the soft session on overseas bourses.