Subscriber Questions (CBA, ZML, ILU, WOW, PTM, TGA, MXT, LNC, BAL, DMP)

The ASX200 has broken out with a bang over the last 2-weeks rallying almost 5% in very quick time. US stocks continue to trade around their all-time highs and everything looks healthy with the stock market for now! We remain bullish local stocks targeting a clear break of the psychological 6000 area in 2017 / 8 although that is now pretty close. However from a risk / reward basis we would not be chasing stocks at current levels in general terms as we continue to believe a ~5% pullback is close at hand for US stocks which is highly likely to slow down the recent advances locally.

This week we again received a record number of questions which is simply great and we’ve managed to cover 9 in this morning’s report, we are sorry if we could not get to yours and if the answers are a touch shorter than usual but most importantly thanks, keep them coming!

Please note in all answers we are only offering General Advice, we are not taking into account investors personal circumstances.

ASX200 Daily Chart

If we were specifically looking at US stocks we would continue to increase our cash levels in anticipation of a correction.

US NASDAQ Weekly Chart

Question 1

“Hi MM, Thanks for this report. It is interesting to see what you do. Would you please explain the Daily Seasonal Stock Composite for CBA? What exactly is it, and how is it derived? Also, how can it be used?” - Kind regards, Nick B.

Morning Nick, thanks for question on what we believe is a very useful subject. I have shown 3 different seasonality charts for CBA, the first from Bloomberg and the next two from Seasonaltrader (https://www.seasonaltrader.com) which we subscribe to. We like to use a number of different tools to assist our investment decisions, especially around timing, but we also strongly advocate the old adage KISS – keep it simple stupid. Hence when we look at CBA from a seasonal perspective our conclusions are kept very general / simple:

1 Late April is an ideal time to lighten exposure to CBA / local banks.

2 The optimum time to buy CBA is late September / early October.

3 CBA usually has a decent pullback in mid-November but will be higher after Christmas.

Both respective sources will outline how they calculate their respective charts but we simply use them for a visual guide and when we want more in-depth numbers we simply crunch them by hand ourselves e.g. the last Weekend Report when we looked at CBA.

1CBA Seasonality Chart

Question 2

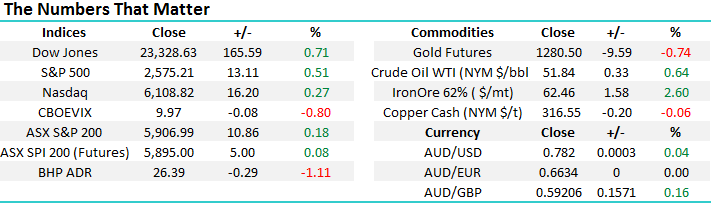

“Hi MM One for Subscribers Questions. ZML. I really have made a mess of this of this one and let it get away from me. I bought it at .83 last November. They put out a reasonable quarterly report today and they have gained 7%. Crikey I am in good company, Westpac recently bought 17% at .81. May I have your thoughts about ZML” - Regards Alex R.

zipMoney (ZML) is a credit lending company that provides online credit solutions for their shopping and payment needs – obviously a growing market and they have some very good tech to go with it. From an investment perspective, one of the key risks to this company as I saw it was around access to credit with NAB providing the funding. They recently got Westpac on board and this alleviated one of my concerns by diversifying their funding source, and getting WBC to make a meaningful investment along the way. Since then however, the company has been weak engaging with institutional shareholders, and I think this is now being reflected in the price of the shares. Another concern is around competition in a very competitive space with a number of other ‘lending platforms’ competing hard.

That said, we do like the story and technically ZML looks attractive and probably headed back over 80c in the shorter term. The stock would need to spend some time under 60c for us to lose confidence in this bullish view.

zipMoney Ltd (ZML) Weekly Chart

Question 3

“Hi MM, Can you please advise what you think of the IPO for Spheria Emerging Companies? Also, what do you think of ILU shares at the moment?” - Thanks, V.N.

Morning, we have not looked into Spheria so can’t add a lot of value there. In terms of ILU, it looks very similar to many of the resource stocks e.g. BHP and RIO. The trend remains bullish and we would be looking to buy weakness with ideal entry around the $8.50 region however we would consider starting to accumulate under $9.

Iluka (ILU) Weekly Chart

Question 4

“Do you offer a managed fund that I can invest in that follows the Growth portfolio, I don't have the time myself but like your ideas?” - Thanks Neil B.

Morning Neil, thanks for the interest. Through my team and I at Shaw and Partners we offer Managed Accounts that reflect our approach at Market Matters. Please get in contact if you would like more information around this.

ASX200 Monthly Chart

Question 5

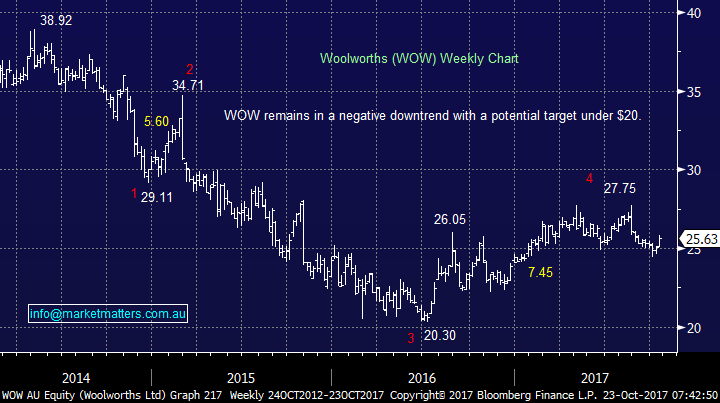

“G'Day, I have some shares in WOW which I paid $33 for and think it will be a looong time before I see that again. I would like to get rid of them but don't want to sell them a week before they jump a dollar. What would you consider a fair price at this time please? I also have some PTM which I bought for $5-00. Not complaining about these. But am I being greedy hanging on...??? I would appreciate your opinion please.” – Waz.

Morning Waz, unfortunately your questions are tricky as it comes down to a very short-term view which is where the most noise / errors occur but here goes:

1 Woolworths (WOW) – a bounce back towards $26.50 would not surprise but overall we remain bearish the stock.

2 Platinum (PTM) – PTM has enjoyed a great run, well done! We would actually be buyers back under $7 believing a test of $8 is on the cards moving forward.

Woolworths (WOW) Weekly Chart

Platinum Asset Mgt. (PTM) Daily Chart

Question 6

“Hi team, a question for Monday morning perhaps. I'm interested in whether you have a view on Thorn Group (TGA). The share has been battered over the past couple of years and has taken a further dip this week on an earnings warning. Wonder whether you think it's been oversold and now represents some longer term value?” – Thanks Steven M.

Hi Steven, You’re asking if it’s time to catch the proverbial falling knife! We are not particularly excited by TGA’s business model of renting out electrical appliances and see no reason to be hero’s just here. Interestingly, ZML as discussed above is the new breed of offering in this space, with the likes of Thorn and Flexi Group suffering as a consequence. Simply put, too much risk to earnings and thus the dividend. It’s cheap for a reason!!

Thorn Group (TGA) Monthly Chart

Question 7

“Hi, James bought MCP weeks ago and performing very good, now i am just considering to apply Bendigo bank new hybid. just a few question about it. does the bank bill rates adjust with interest rate change? also does the hybid can sell at any time on the share market? any risk behind it? another one is you mentioned on Monday for your two kids share gift. whose name should i use if i would like to do the same thing for my two children. and any tax implication on that?” – Michael S.

Hi Michael – thanks for the email. In terms of MCP (MXT), the listing has been well received closing at $2.07 versus the issue price of $2.00. With an expected yield of around 4.75% and some capital gain from the outset, the returns from a low risk fixed income vehicle are shaping up to be good, although it is only early days. Regarding questions on the Bendigo Hybrid I’ll separate these out;

Does the bank bill rates adjust with interest rate change?

Yes, it will rise and therefore these are classified as Floating Rate securities with the yield going up as interest rates go up. We have no interest in buying fixed rate securities at this point in the interest rate cycle.

also, can you sell at any time on the share market?

Yes, liquidity permitting. They trade the same as a normal share in terms of trade and settlement procedures, and sit in your normal broking account.

On the tax question, best to speak with your accountant, however if opening an account to hold shares, the holder must be over 18. If not, the account can be opened in the name of the parents, with the designation being the child.

Question 8

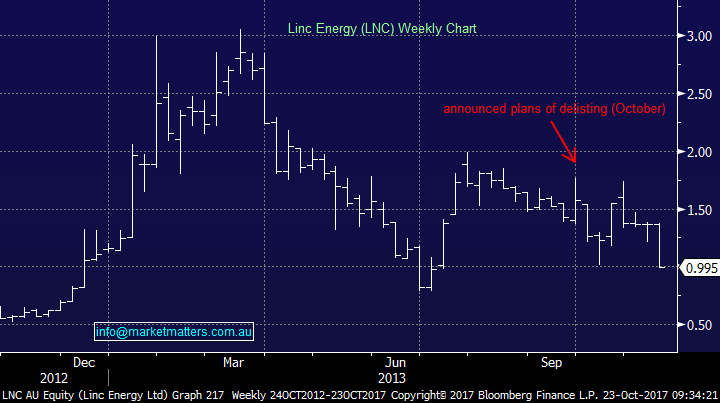

Hi James, followed you with RRL, good little result. Just a quick question, I recently bought shares in LNG who were originally based in WA, have an office based in Texas, and are now considering moving off shore completely to USA, listing over there, and possibly ending their listing on the ASX.

If the move goes ahead, will it affect the ASX share price leading up to the move, and what would happen to any shares I might be holding after the move ? I've been with MM for about 18 months now and still very much appreciate your market appraisal and independent thinking. Having fun,” – Greg T.

Hi Greg – typically the share price is impacted negatively when that plays out, as local fund managers may not be able (within their mandates) to hold internationally listed stock while retail investors may think it’s ‘all too hard’. In time that weakness may be offset by buying from international investors however for me, it simply complicates the issue too much. Should you continue to hold the stock, a good broker can hold both ASX shares and International shares, however the costs of execution are typically more for international stock + you have the added complication of the currency. One example that springs to mind is was Linc Energy (LNC) for those that might recall. Peter Bond was the CEO there and they were very critical that Australian investors were not adequately valuing the stock, so they moved to Singapore. There was decent selling before they moved, and in that instance, they eventually appointed administrators. Maybe Aussie investors weren’t as naïve as the company thought!!

Linc Energy Weekly Chart

Question 9

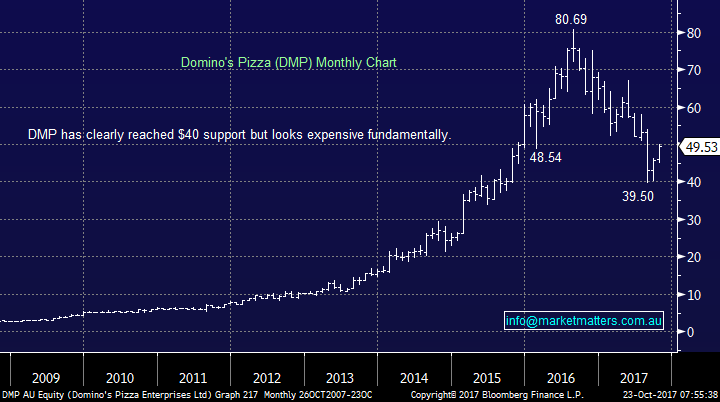

‘Hi, I'm currently holding BAL & DMP, I'm in profit on both stocks wanted to get your advice on possible exit price range without leaving too much profit behind.” – Neil P.

Morning Neil, good timing with excellent bounces in both stocks as the market has scrambled to deploy funds with previously beaten up stocks garnering much attention. Similar to question 5 short-term market timing does leave plenty of room for error but this is one of the reasons we look at Technical Analysis:

Bellamy’s (BAL) – If we were long we would be taking half profit and running stops under $9.

Domino’s Pizza (DMP) – Were not as keen on DMP technically and / or fundamentally at current levels and would consider taking profit over $49.

Bellamy’s Australia (BAL) Daily Chart

Domino’s Pizza (DMP) Monthly Chart

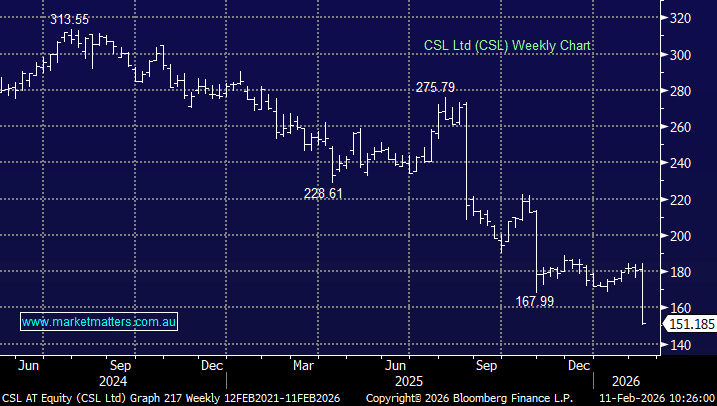

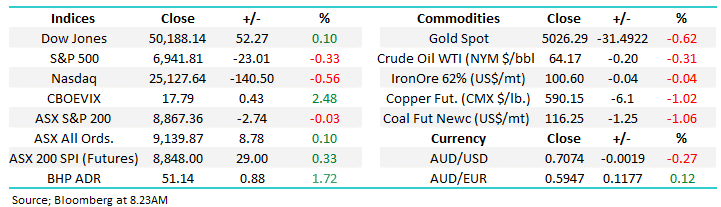

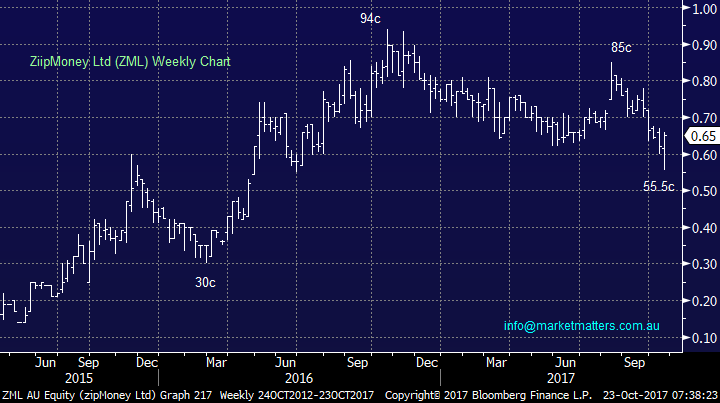

Overnight Market Matters Wrap

· The US indices powered into record territory on Friday night, on expectations that President Trump's long expected tax reforms are one step closer. The Senate voted marginally in favour of a budget vehicle that could support the mooted tax plans. - US Financial exposed stocks such as Macquarie Group (MQG) is expected to outperform the broader market on the back of this.

· Bond markets continued to pullback with the benchmark 10 year treasuries nudging 2.4% while the US$ firmed against most major currencies.

· Commodities were mixed, with oil recovering ~1%, gold losing ground to US$1280.50/oz. and industrial metals steady to firm. BHP is expected to underperform the broader market today, after closing in the US an equivalent of -1.11% to $26.39.

· The December SPI Futures is indicating the ASX 200 to open 11 points higher towards the 5695 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here