- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

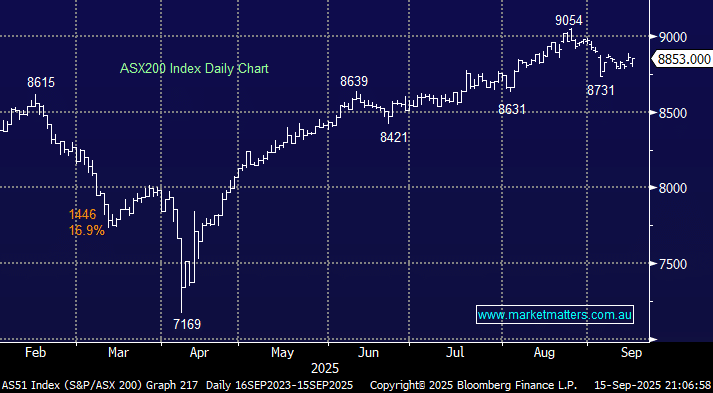

The ASX 200 slipped 0.1% on Monday as investors continued to “buy the dip”, allowing the market to recover from an initial 0.8% fall. The winners managed to outnumber the losers on the main board, but weakness in heavyweights CBA, BHP and CSL was enough to drag the index into negative territory, albeit just. The healthcare sector was the weakest on the day, extending its loss so far this year to 14.8%. More on this sector later, including a look at the US, to avoid being too influenced by heavyweight CSL.

The local market feels like it’s walking on a knife-edge into Wednesday, as it struggles to keep up with US stocks over recent weeks, with the S&P 500 again posting new highs overnight. We are looking at two very different scenarios come the end of the week. Either the US advances after the Fed decision, and the ASX plays some aggressive catch-up on the upside. Or, the S&P 500 reacts badly to Jerome Powell and co., and the ASX200 quickly lives up to its September reputation.

- Investors remain focused on the US Federal Reserve’s decision on monetary policy, later this week. Anything less than a 0.25% cut accompanied by dovish rhetoric is likely to weigh on rate-sensitive stocks and sectors.

The majority of overseas markets started the pre-Fed week in positive fashion. In Europe, the EURO STOXX 50 closed up +0.9% while the UK FTSE slipped 0.1%. In the US, the tech-based NASDAQ gained +0.8% while the S&P 500 closed up +0.5%, both at fresh highs.

- The SPI futures are calling the ASX200 to open up +0.5% this morning, aided by a 1.3% advance by BHP in the US.