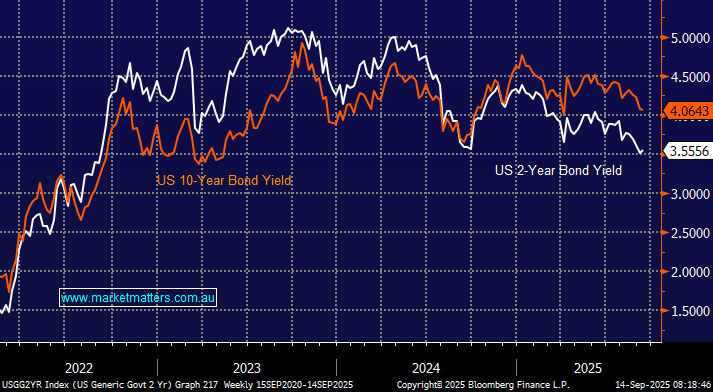

The yield difference between the US 2s and 10s, or “Yield Curve,” is widening at present. Markets are convinced that a number of rate cuts are looming in the coming year, while they are more cautious about the path for growth and inflation. Currently, the U.S. yield curve is “partially inverted,” which suggests markets are pricing in Fed rate cuts but also slower growth ahead. Historically, todays condition is a recession warning, which can weigh on cyclical sectors (banks, industrials, consumer discretionary) but may support defensives (utilities, healthcare, staples). However, at the moment, U.S. stocks are holding up because investors expect Fed rate cuts to soften the slowdown, but if the curve stays inverted too long, recession fears could drag equities lower.

- If the yield curve continues to widen, it will ring alarms for stocks currently viewing economic conditions through rose-coloured glasses.