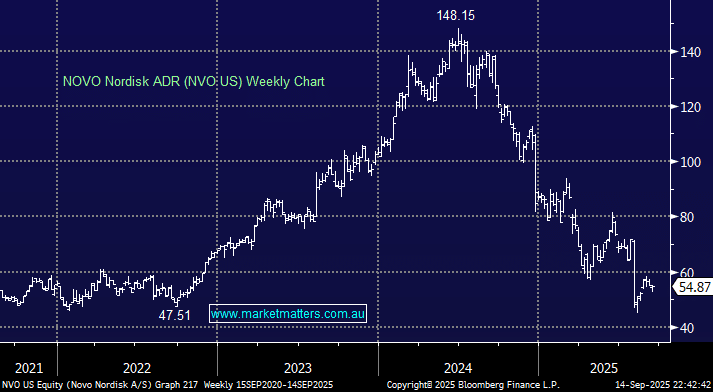

Moderna (MRNA US) was smacked almost 9% on Friday night as the Trump administration waged war on Covid shots, just what it didn’t need after plunging ~95% from its 2021. Similarly, in a different area of the healthcare sector, the makers of Ozempic, Danish firm NOVO Nordisk, has fallen over 60% from its 2024 high, similar moves to those witnessed by lithium names after the EV hype didn’t deliver on the bottom line as markets assumed. Markets regularly get too euphoric around certain stocks and sectors, with three coming to mind today: defence, gold and AI. When markets boom, new competition increases. Now, 5–6 major prescription weight-loss drugs are widely available, mainly in the GLP-1 receptor agonist class, weighing on NVO’s share price. Similarly, look at the number of new EVs on the road; not so many are Teslas today.

- One of the most challenging jobs for investors is deciding when to disembark from the “Hot” trades and when to believe we are witnessing a structural shift.

We believe AI will have a massive impact across markets but there will be some big winners and losers, its going to keep us on our toes in the coming years.