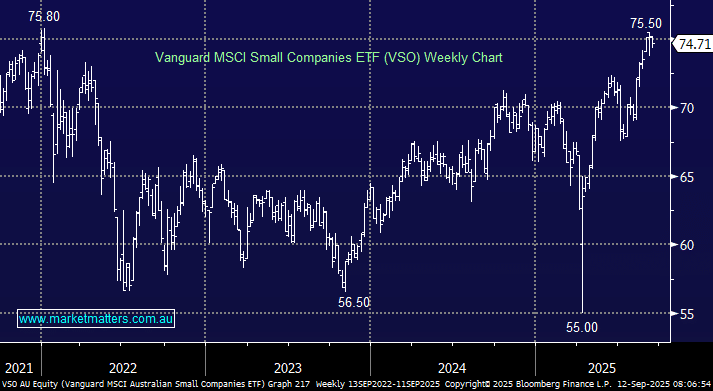

We continue to hold a bullish view on the Australian market heading into 2026, noting that small-caps have been at the forefront of this year’s gains, outperforming the ASX 200 by close to 10% year-to-date. Until markets lose faith that central banks are going to ease rates into 2026, we believe the small-caps will outperform, especially as they don’t carry the same lofty valuations as many of the big board names. There are 3 main ETFs which track the ASX200 Small-ordinaries index, with our preference being the VSO ETF due to its relatively low 0.3% fee, solid +1bn size, and tight spreads. Simply, it’s the cheapest, largest, and best liquidity available.

- The VSO ETF aims to track the Australian small-cap index, including dividends; it currently holds 16% in mining, 12.8% in REITs, 6.8% in Retail, and 5.4% in Software.

- The ETF tracks its benchmark pretty well: Over the last three years, it has gained +10.2%, while its benchmark is up +10.6%.

The small caps have run strongly through 2025, but many valuations remain modest compared to the major names. With rates set to fall, we remain bullish until further notice.

- As we approach 2026, we like the rate-sensitive VSO, which we own in the MM Core ETF Portfolio.