- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

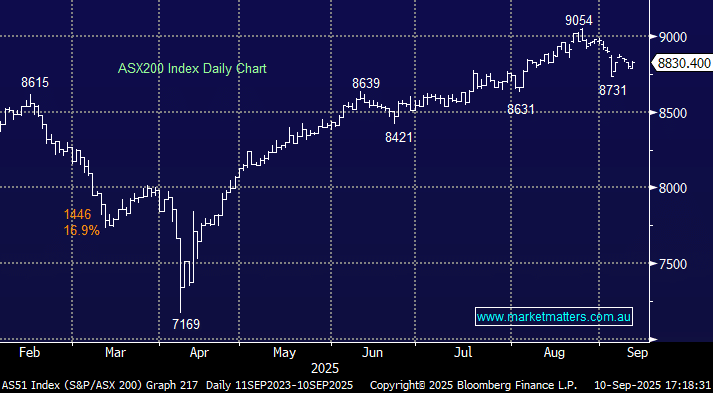

The ASX200 advanced +0.3% on Wednesday, but the performance was extremely polarised on the stock and sector levels. Less than 45% of the main board advanced, but when the “Big Four Banks” rally an average of more than +1.5%, the index will always be hard to suppress. The materials sector was the only meaningful drag on the index, falling 1.7%, with gold and iron ore stocks retreating even though their respective commodities were firm. However, it was a very different story in the lithium space, where it was a sea of red across Australasia – more on this later. To put the day into perspective, the financials added almost 40 points to an index which only closed up +27 points, whereas the materials stocks dragged the index back around 29 points.

China’s consumer prices in August fell 0.4% from a year earlier, weaker than the estimated 0.2%. This weighed slightly on China-facing local stocks but had no influence on China’s market. The Hang Seng China Enterprise Index closed up +0.9%, posting new 3-year highs in the process. Australian miners are closely correlated to the health of the Chinese economy, which feels like it has reached its nadir as equities pre-empt a bullish turnaround. At MM, we remain overweight in the ASX Materials Sector, which has advanced around 6% over the last 3 months, but we aren’t planning on reducing our exposure in the near future, with the possible exception of our exposure to gold.

Overseas markets were mixed overnight, even after Oracle (ORCL US) surged 35% higher. Sentiment was initially higher in the US after the latest producer price index print showed that wholesale prices fell 0.1% in August, the first drop in the inflation read in 4 months, compounding the argument for a rate cut this month. The S&P 500 posted new highs with the AI Trade leading the line, buoyed by Oracle. However, while the S&P 500 ultimately closed up +0.3% the Dow slipped 0.5%. In Europe, it was also a mixed session with the French CAC advancing +0.2% while the German DAX fell 0.4%.

- The SPI Futures are calling the ASX200 to open 0.2% lower this morning following the mixed session on overseas bourses.