Hi Glenn,

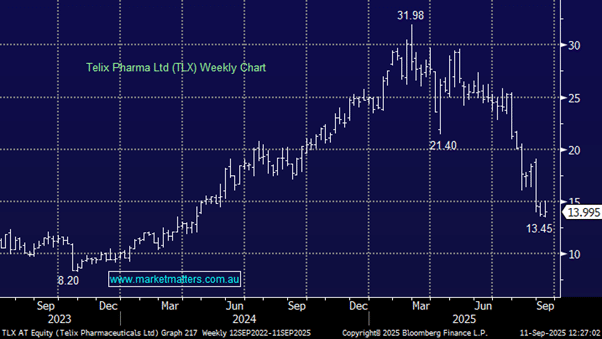

As a bio tech, albeit a well-established $4.7bn company, volatility is to be expected but its aggressive decline has surprised even us who generally avoids the space due to the succession of binary outcomes – we thought it was looking interesting below $20, now it’s struggling to hold above $14.

In 2025, TLX has faced regulatory setbacks, including FDA rejections (CRLs) for its kidney and brain cancer imaging agents due to manufacturing and data concerns. The company also disclosed an SEC subpoena related to its disclosures on prostate cancer therapies, triggering an additional sharp share price drop. These issues have shaken investor confidence to the point where is starting to feel like it cannot get any worse!

We think it still looks interesting here, with the market basically applying no value to new products. It does feel like accumulating into current weakness will pay dividends over the next 6-12 months but it’s not for the fainthearted. It’s one we’re looking at now for the Emerging Companies Portfolio.