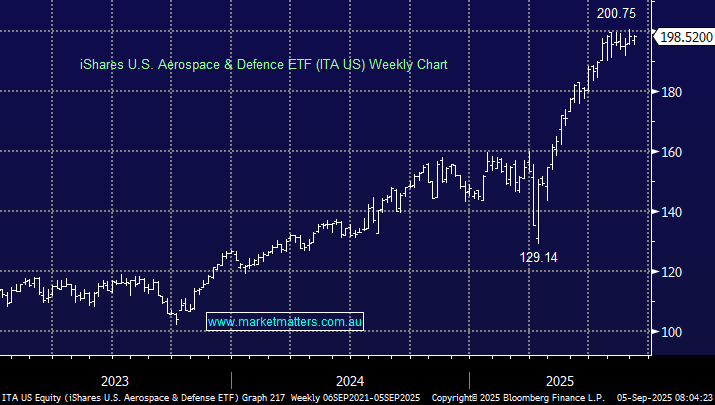

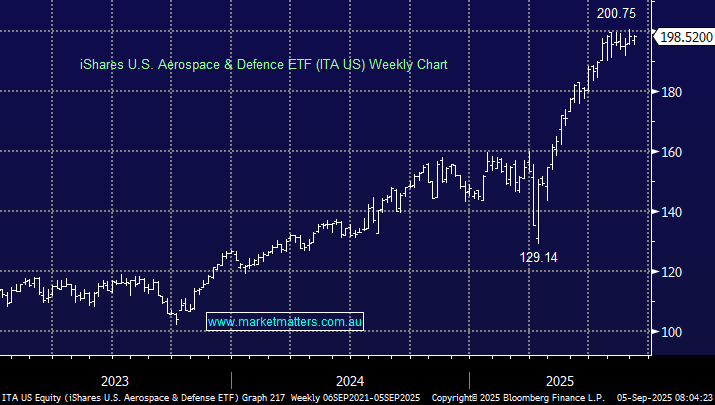

The ITA ETF tracks the Dow Jones U.S. Select Aerospace & Defence Index and it simply dwarfs the local alternatives with a market cap of $US9.2bn while fees are a low 0.38% pa. This ETF is best for investors wanting pure U.S. exposure to the biggest prime contractors. Performance tracking has been good, over the last 3-years the ETF is up +26.4% compared to the indexes +27%, year-to-date its lagged the others three ETFs gaining ~36%.

- From a regional perspective the ETFs is solely focused in the US.

- The ETF holds 39 stocks with its 5 largest holdings General Electric 21%, RTX 15%, Boeing 9%, Northrop 5%, and General Dynamics 5%.

This ETF has huge scale but it focuses on the more mature end of the defence space.

- We like the risk/reward towards the ITA ETF around the $US190 area.