- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

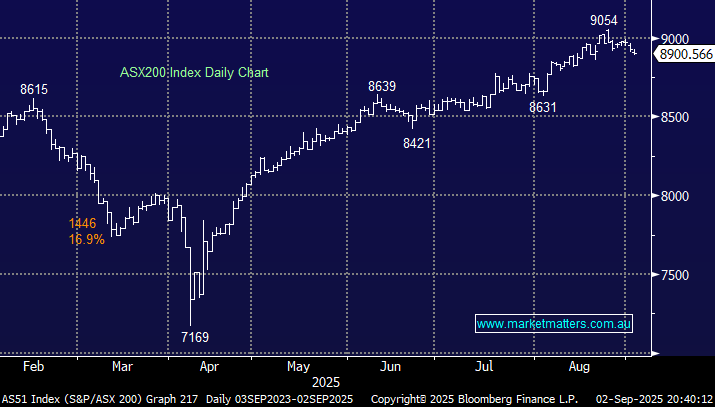

The ASX200 slipped 0.3% on Tuesday, with over 65% of the main board closing lower, led by the consumer discretionary and staples sectors. With reporting season behind us, the local market feels tired and lacklustre after its +26% rally from its panic “Liberation Day” April low. Last month’s reporting season was a solid beat compared to FY24, which was reflected in the markets’ +2.6% gain compared to the slight fall in 2024. However, we believe we are in a market driven primarily by liquidity as opposed to earnings, helped by further rate cuts expected over the coming quarters – a solid bullish tailwind at this stage of the cycle.

- On Tuesday, the ASX200 was also weighed down by Bendigo (BEN), Worley (WOR), Wesfarmers (WES), Woolworths (WOW), Santos (STO), Sigma (SIG), and Northern Star (NST), all of which traded ex-dividend.

An impressive 15% of the ASX has advanced by more than +20% over the last month. When MM decides to increase our market risk, we will most likely be “shopping” amongst these “winners.” Our ideal targets are companies that have delivered strong FY results and provided positive guidance, but whose share prices have pulled back during any broader market correction — rather than chasing beaten-down bargains.

With cash levels on the higher side across some MM portfolios, we are focusing on areas and stocks to move back up the risk curve this side of Christmas, but we are in currently in no hurry. Market uncertainty is on the increase as the legality of tariffs is called into question, while US 30-year bond yields approach 5%, not the ideal backdrop as we enter September with stocks trading around their all-time highs. At this stage, we see initial support ~ at 8850, and if this doesn’t hold, a retest of 8600 cannot be ruled out, only ~3% lower.

- Seasonally, November and December deliver the best gains for the ASX200, but our focus will remain more on the individual stocks than the index.

Overseas markets were on the back foot overnight, with Europe delivering the worst losses. The German DAX fell 2.3%, and the EURO STOXX 50 fell 1.4%. In the US, tech led the declines, with the Nasdaq retreating 0.8% and the S&P 500 retreating 0.7%.

- The ASX200 is set to open down another 0.4% this morning following the soft sessions across global bourses.