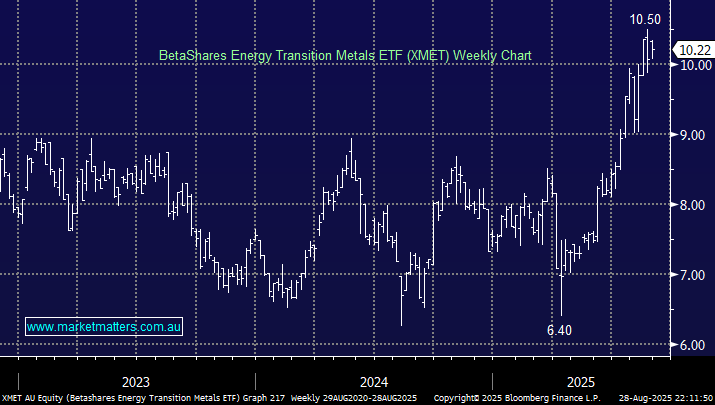

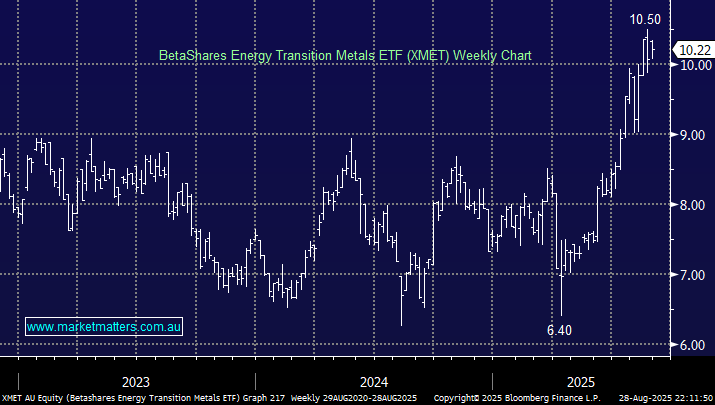

In terms of ASX-traded securities, we think the XMET ETF is a solid way to play the thematic, which presents a focused approach to gaining exposure to materials that are critical to the energy transition, especially EVs, renewables, and battery infrastructure. With its ESG filters, it offers a cleaner alternative to conventional materials funds. That said, it remains concentrated in a volatile, commodity-sensitive space, with various exposures, not just exclusively rare earths.

- From a regional perspective the ETFs main exposures are 33% Canada, 21% Australia, 19% the US, 9% Chile and 7% in China.

- The ETF holds 37 stocks with rare earths stocks MP Materials and Lynas its two largest positions coming in around 19%.

This is far from a perfect rare earths play but it has a decent correlation to the sector while costing 0.69% pa. This is a solid a ASX-traded ETF for exposure to the energy transition theme as opposed to purely rare earths.

- We like the risk/reward towards the XMET ETF below $9.50.