- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

- Market Matters Reporting Calendar: Australian FY25 Reporting Calendar in PDF Here & Spreadsheet Here

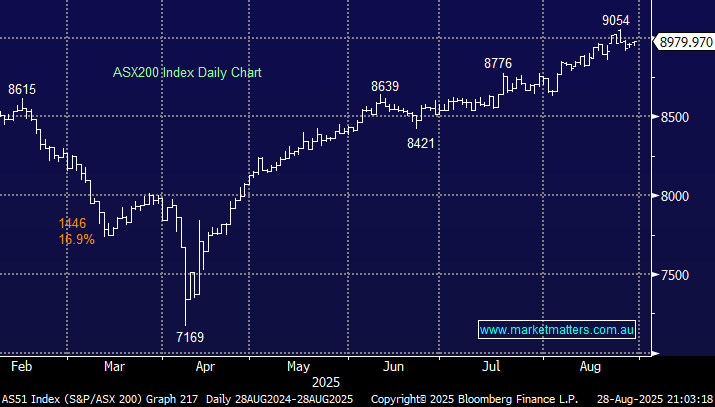

The ASX 200 advanced +0.2% on the penultimate trading day of August, taking its monthly gain to +2.7%. As we often say, there are “lies, more lies, and statistics,” and in this case, the average decline for August and September combined over the last decade before 2025 was around -3%. Interestingly, when August managed to close positively, it was followed by a poor September. Time will tell this year, but the market is feeling tired.

Thursday’s gain was driven by the “Big Four” banks, although a 7.7% fall by the Bank of Queensland (BOQ) following its FY25 report took the shine off the broader banking sector. Less than 40% of the main board closed higher, but it’s hard to argue with the banks, especially when CBA and NAB both advanced more than +2%. Elsewhere, the day was again all about the reporting season and news flow, with six stocks advancing and falling by more than 10%:

Major Movers: IDP Education (IEL) +29.7%, Lifestyle Communities (LIC) +14.9%, Eagers Ltd (APE) +12%, Telix (TLX) -18.8%, Nine Entertainment (NEC) -12.2%, and Ramsay Health Care (RHC) -10.5%.

During our day session, the S&P 500 futures were relatively volatile as they tried to second-guess how the market would ultimately interpret Nvidia’s latest quarterly results – in hindsight, it was much ado about nothing with the AI behemoth slipping by less than 1% when before its result, option markets had been pricing in a move of +/- 6%.

Overseas markets were largely firm overnight except for parts of Europe. The EURO STOXX 50 finished up +0.1% but the UK FTSE slipped 0.4%. In the US, the S&P 500 finished up +0.3% while the tech-based NASDAQ led the line, advancing +0.6%.

- The SPI Futures are calling the ASX200 to open down 0.4% this morning, ignoring gains on Wall Street.