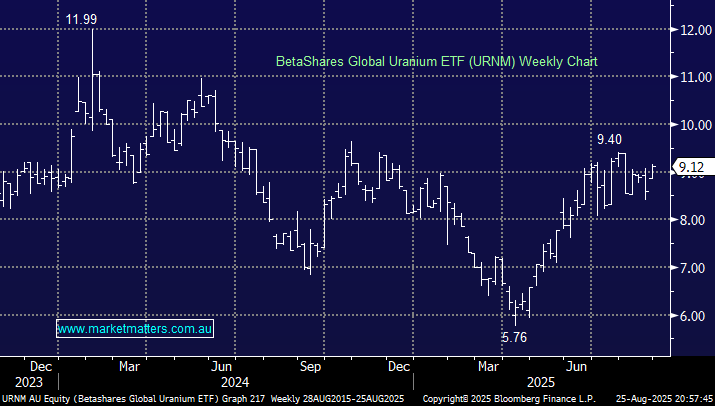

The local uranium story feels like a combination of the gold and copper narrative, with panic buying unwinding and ASX underperformance prevailing. The ASX-traded Global Uranium ETF (URNM), which has a small exposure to ASX names, has advanced 12% year to date after enduring a sharp sell-off into April. It has largely followed the underlying uranium price, although this can be hard to track at times.

- We are bullish on the increasing global adoption of uranium for energy in the years ahead.

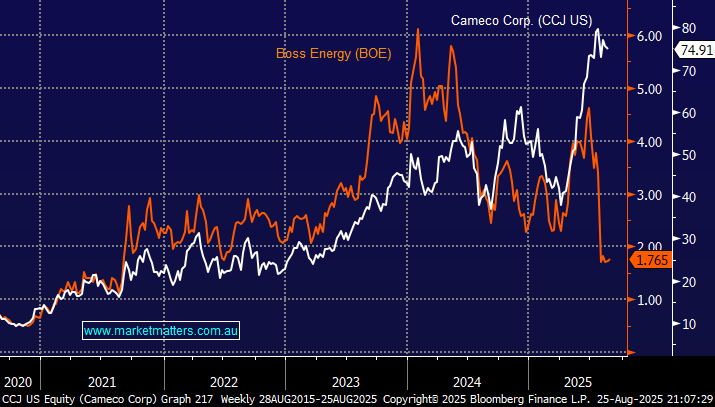

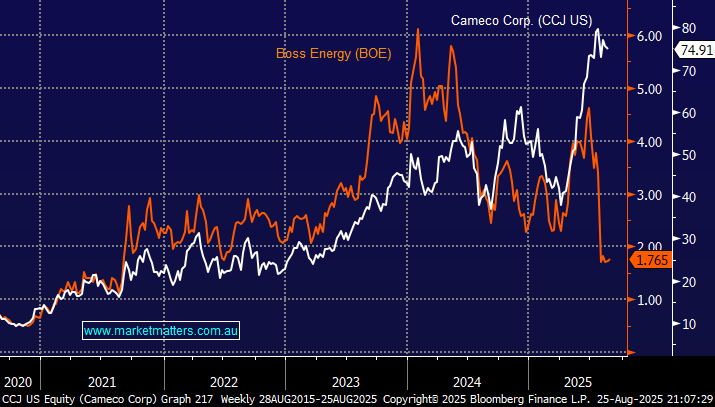

Again the ASX miners have disappointed although in the case of uranium it’s been a largely more painful experience. Cameco (CCJ US) which we hold in our International Equities Portfolio has rallied +46% year-to-date making fresh all-time highs in recent months, whereas some local names are enduring a relative shocker: Boss Energy (BOE) -27.4%, Paladin (PDN) -7.9%, and Deep Yellow (DYL) +41.3%. Two standout points here:

- Picking the sector doesn’t always translate to success on the stock level, as mining companies can disappoint on a number of metrics.

- Again, we saw panic frenzy buying of local uranium names, this time in early 2024. Such activity can often end in a reality check.

We like the uranium theme in the coming years, but at the stock level, there will be plenty of twists in the road.