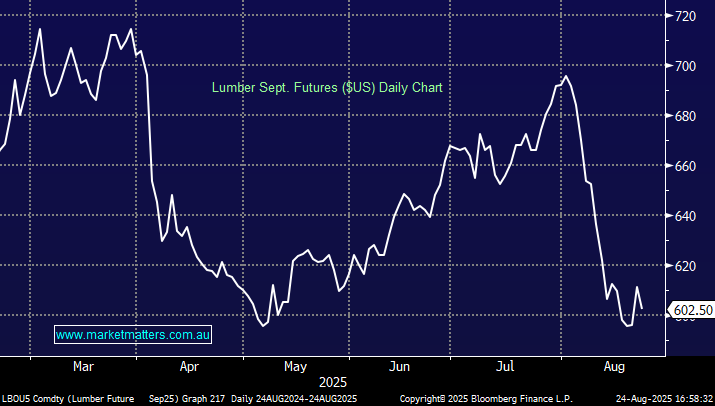

Lumber, like copper, is often viewed as a leading indicator of economic health. Prices have dropped more than 14% from a record high in early August, as buyers’ bets on tariffs and interest rates backfired. Many homebuilders, contractors, and retailers had wagered that higher U.S. tariffs would lift lumber costs, while lower rates would spur demand. Instead, those expectations have failed to materialise, leaving the industry facing a sharp pullback in prices and still waiting for the structural demand boost that companies like James Hardie (JHX) just told us is not yet in sight.

- Lumber prices are telling us the Fed are behind the curve with interest rates and should already be cutting.

We are bearish on lumber prices over the weeks/months, but most of the decline already looks to have played out, with rate cuts finally set to offer some relief.