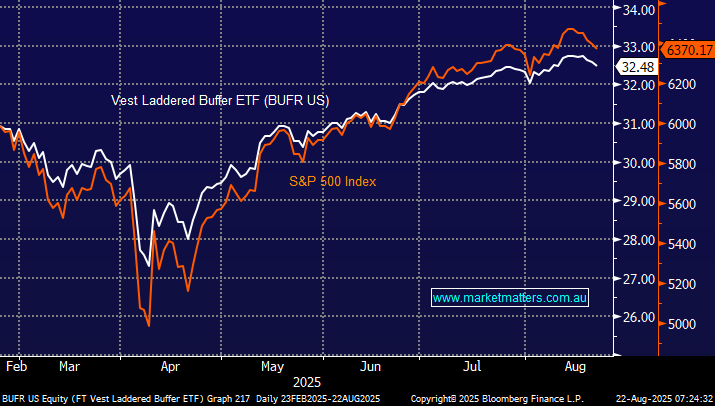

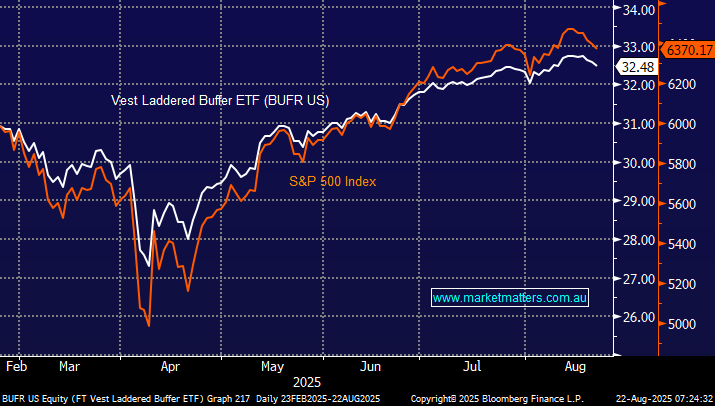

The BUFR is a very successful Buffer ETF with a market cap of $US7.2bn, the same size as Newmont (NEM). As the chart below illustrates its tracked the S&P 500 closely through 2025 which is to be expected until the respective buffer levels are hit. Its important to understand that this ETF is not set and forget which would have the option strategies comparatively redundant as the market moves. BUFR is structured as a laddered portfolio of several FT Vest U.S. Equity Buffer ETFs, each corresponding to different outcome periods throughout the year – you get a lot for your money, hence the 0.95% pa fee seems reasonable to MM.

BUFR gives investors broad exposure to the S&P 500 with built-in downside protection, using multiple overlapping periods instead of relying on just one. Because BUFR holds 12 different buffer ETFs, each with a different starting month and strike level, investors are never “locked in” to a single starting point. This smooths out timing risk. The key points are:

- Buffer: Protects the first ~15–17% of losses; beyond this, investors begin to incur losses.

- Cap: Limits maximum gains to around +8.5%, even if the S&P 500 rises more.

- The laddered structure ensures that at any time, one or more underlying ETFs is in its outcome period, smoothing returns across months.

With the S&P 500 having rallied strongly from its April lows its easy to comprehend why investors want some cover:

- We like the idea of a buffer ETF for exposure to US stocks after such a strong advance.