Hi Glenn,

Picking one out of that list is tough, and they are different types of stocks, with different risk profiles and reasons for owning them. In short, we’re more a seller than a buyer of JHX now, MGR is 50/50 after a good run, AGL, we’d wait till after WOR reports before making a call there, AGL is good value again, and we like it at current levels, while HSN and RPL are more speculative. We’re not fans of IPH.

Therefore, we’ve chosen a solid performer of late as opposed to a beaten-up name as our preferred option “right here, right now”:

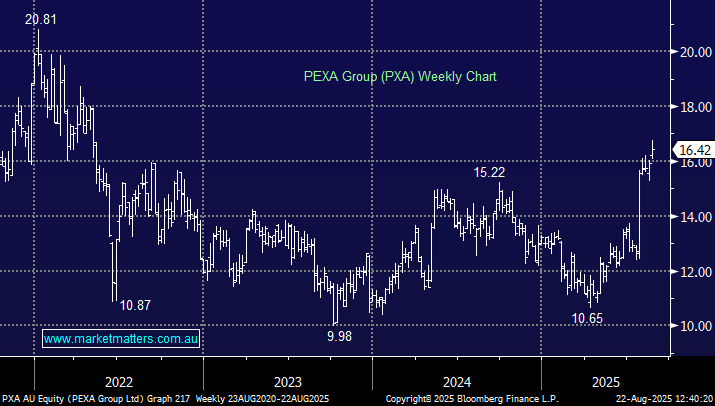

PXA looks good after they signed a deal last month with the UK’s National Westminster Bank to facilitate mortgage transactions on its platform. The company earns transaction-based revenue (fees per property settlement), similar to a SaaS model rather than a traditional hardware or IT services company hence the more users the better. The company is due to report on the 29th so hopefully were not giving it the kiss of death!

- In the 1H revenue was $202.5mn and the markets looking for a similar number for the 2H.

FY26 looks to be a pivotal year for PXA after a lot of investment, a lot of regulatory complexity overcome, and the above-mentioned deal should open up more, driving earnings this year and beyond – we can see PXA trading from strength to strength.