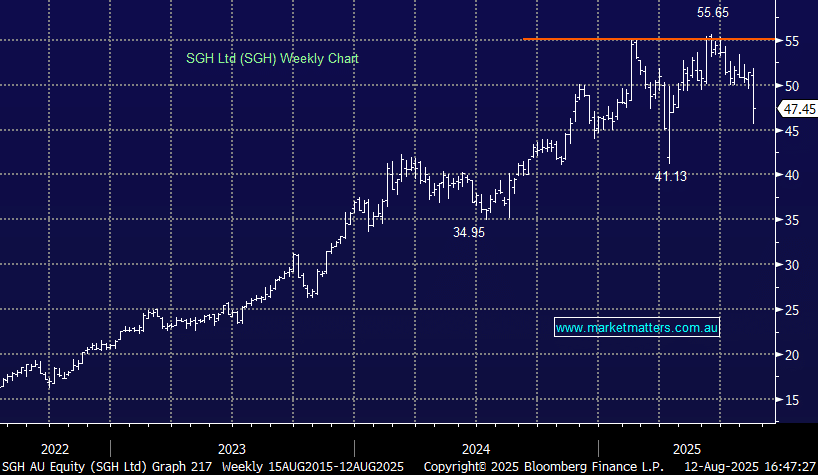

SGH –8.5%: Delivered a strong FY25 result today with earnings up 13% y/y however, guidance for FY26 underwhelmed, an issue for a stock that is well loved (and owned).

- Revenue $10.74 billion, +1.2% y/y relative to consensus of $10.82billion

- Underlying NPAT of $923.7 million, inline with expectations

- Final dividend per share A$0.32

They guided to low to mid single-digit earnings growth (ebit) in FY26 relative to market expectations of nearly 10%. While we think the guidance will ultimately prove conservative, this a relatively crowded trade on the long side and could take some time to find a base to work up from.