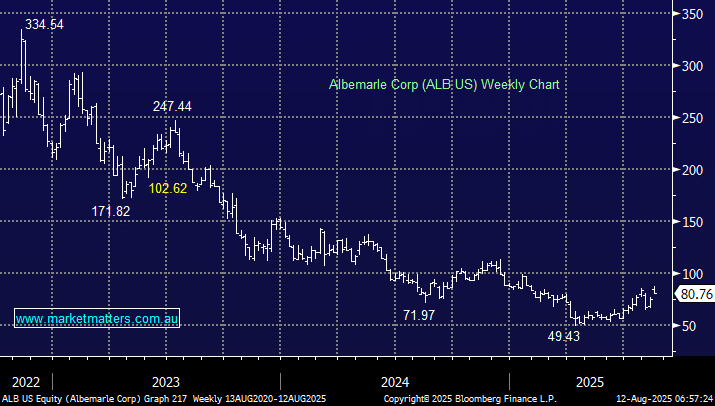

Overnight, US lithium giant ALB closed up +7% on the CATL news. This is not as exciting as yesterday’s moves across Asia, suggesting today’s local session could be more muted. At this stage, US investors have decided to sell into the early strength, with the stock still well below its 2025 high, although lithium made new highs for the year following the news.

- We can see ALB testing $US100 into 2026: MM is long ALB in our International Equities Portfolio.

Lithium stocks dominated the winners enclosure on Monday, with the four we’ve looked at this morning advancing an average of 14.7%. One major tailwind for the local sector is the major short position that’s been squeezed over recent months:

- Pilbara (PLS) 16%, Liontown (LTR) 13.2%, Mineral Resources (MIN) 13%, and IGO Ltd (IGO) 6.7%.

When the “shorts” start to cover, the squeeze can send stocks surging as the buying almost feeds on itself. One day, will not panic the “shorters”, but the risk that China has decided enough is enough for the lithium price is likely to be front and centre in their minds.